As a cryptocurrency trader here’s what you need to look for in a good crypto exchange.

Key Takeaways

- In a crowded crypto market, selecting the right crypto exchange can be challenging

- Knowing what to look for will help you avoid some common pitfalls

- Factors that matter include up-time reliability, security, and low fees

Share this article

Over recent years, there have been hundreds of new entrants to the cryptocurrency exchange market. In 2020, cryptocurrency traders have a vast range of choices available to them, offering the opportunity to trade an array of products under various conditions.

But choosing an exchange doesn’t have to be complicated. Several critical factors should take priority over gimmicky giveaways and glossy marketing campaigns. Here are three considerations that will help you pick the right exchange.

Reliability and Security

When choosing a cryptocurrency exchange, you should be looking for comparable levels of reliability and security as you would when selecting a bank. Unfortunately, this is still quite rare in the cryptocurrency space, with many users falling prey to the problems stemming from a lack of reliability and security.

Some platforms have developed a reputation for downtime whenever there’s a surge in volume, which is a frequent occurrence in the volatile crypto markets. This can significantly impact users who find themselves unable to exit positions while the exchange is down, and the market continues to move against their trades. With well-publicized downtimes for major stock trading apps, we should expect more in the crypto industry.

Furthermore, exchange hacks are still all too common. Many companies simply fail to implement the layers of security that are necessary to protect user funds against theft, creating a honeypot for attackers.

Exchanges that have been around a long time understand these risks. Established in 2013, OKCoin has over seven years of experience in global cryptocurrency markets and has created its own methodology for avoiding downtime. This involves proactively planning for failure by regularly putting systems through stress testing to simulate high volatility and high volumes.

The company also implements a high level of redundancy to ensure that if one system component should fail, there are backups in place. Its record of zero-hacked funds speaks for itself, and OKCoin was one of the first exchanges to offer 24/7 customer support.

Security is also a high priority. OKCoin has a strong track record of keeping hackers at bay for over seven years using a 360-degree approach to fund and data security. Private keys are AES-encrypted according to specifications for the U.S. National Institute for Standards and Technology and securely stored. Transactions are monitored for suspicious activity 24/7.

Finally, the company is committed to educating users about how to keep their crypto secure against various forms of social and psychological attacks.

Low Fees Are Critical for Crypto Exchanges

The math is pretty simple. The higher the fees, the less profit you’ll get from a trade. While the zero-fee stock trading platforms that have emerged will sell your data to high-frequency traders (to give them a significant advantage over retail investors), this practice does not transmit over to crypto exchanges.

This may be insignificant if you’re an infrequent trader who simply buys and holds. However, shorter time frames and larger trades are more greatly impacted by high fees. Even worse, if you’re trading with leverage, both your trade size and your fees will get multiplied, since fees are charged as a percentage.

Some platforms will also levy a fee for deposits and withdrawals, so even if the trading fees appear low, it’s worth making sure you aren’t going to get penalized for attempting to withdraw your profits.

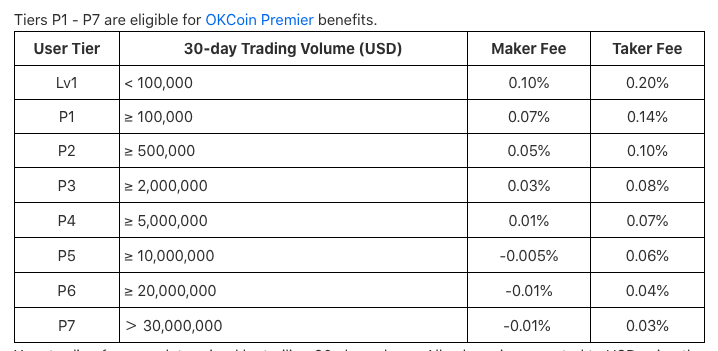

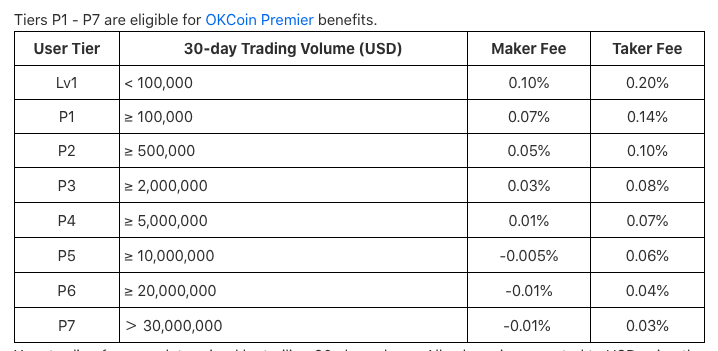

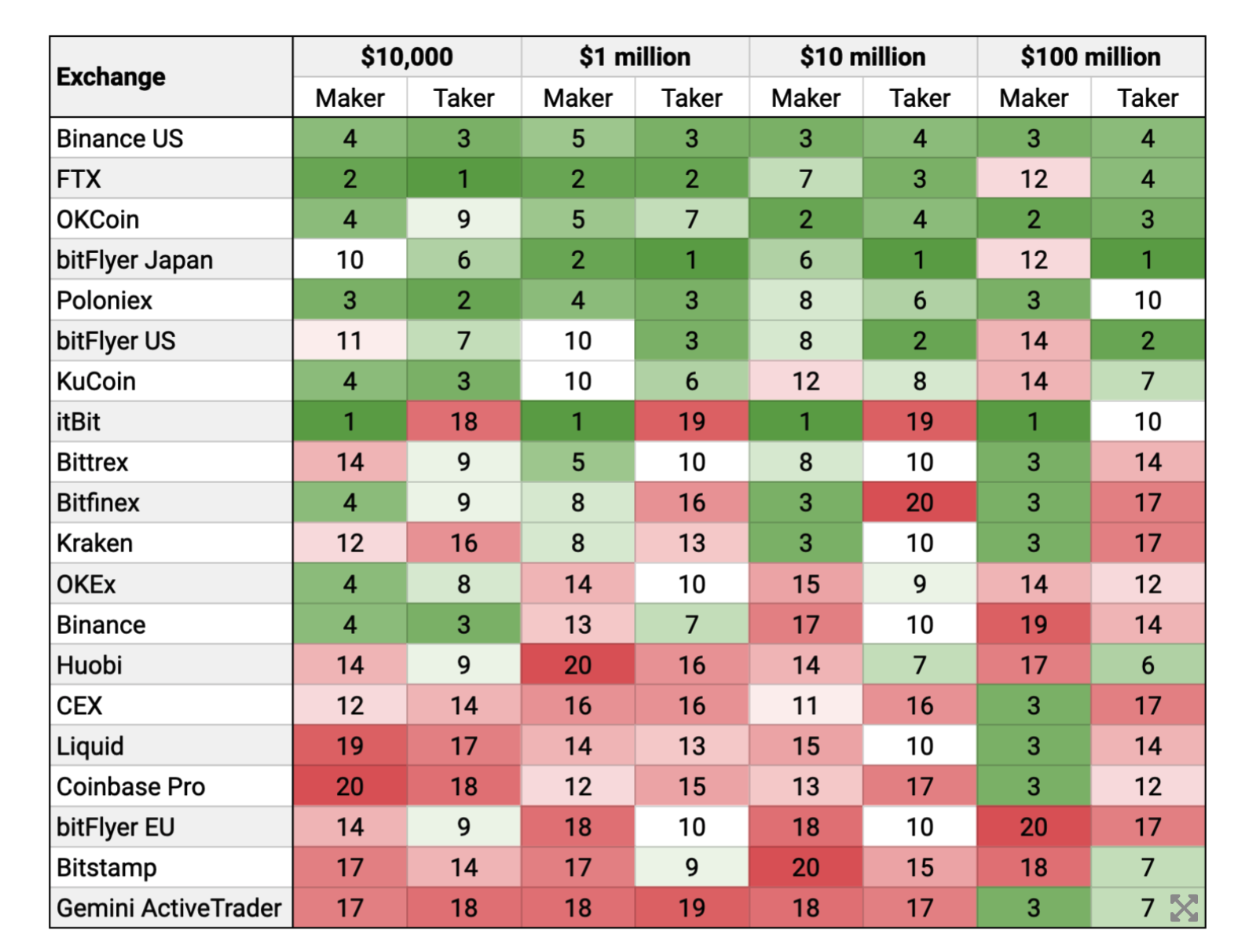

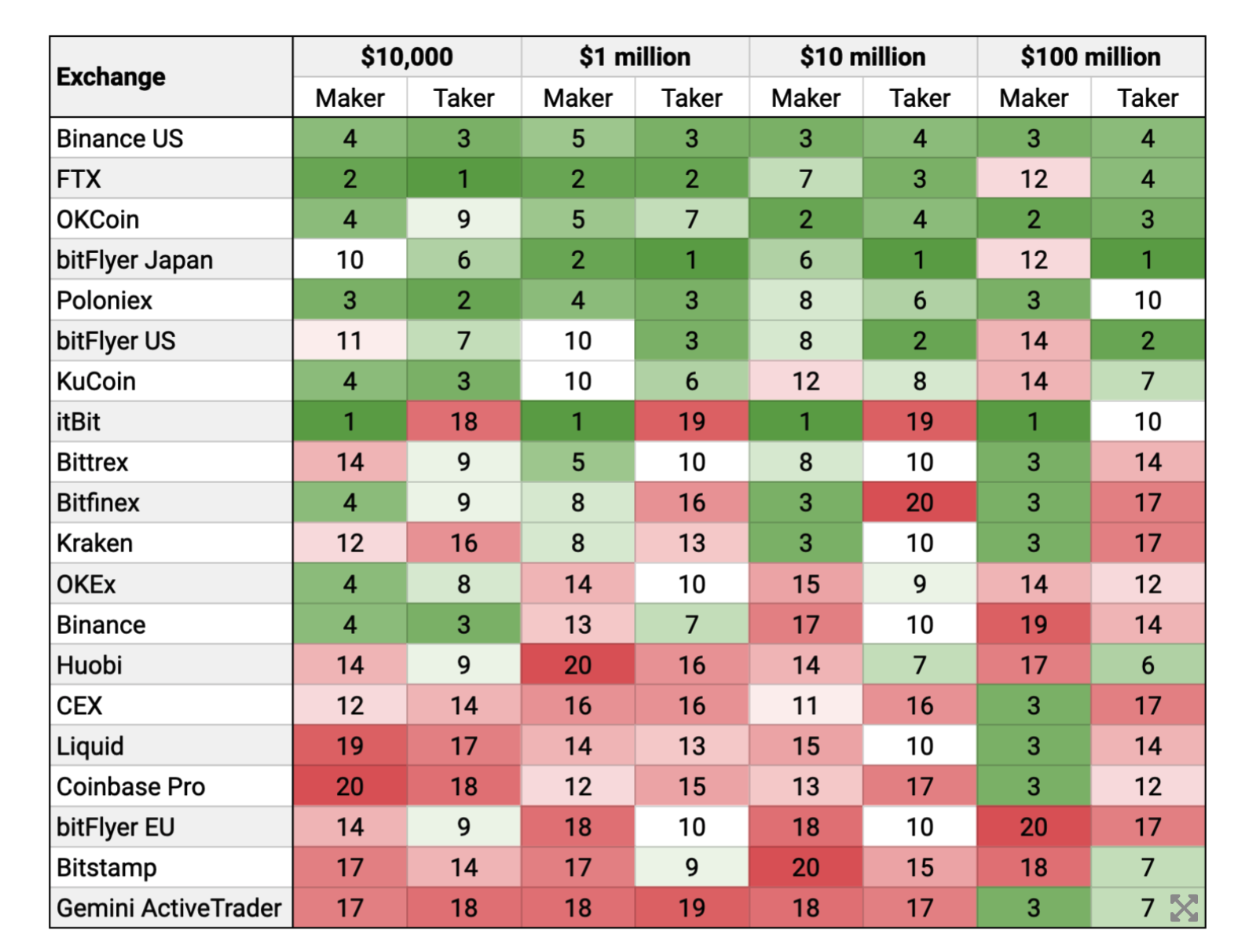

OKCoin charges some of the lowest trading fees among crypto exchanges. It charges fees at a rate that’s about 50% lower than competitor exchanges, which typically charge 0.2% for maker and taker fees. Higher volume traders can also benefit from sliding-scale fee reductions.

The chart below shows a comparison between other U.S. cryptocurrency exchanges.

It’s also free to deposit and withdraw using most banks, keeping the cost of trading low and allowing you to keep more of your profits.

Sophisticated Trading Software and Deep Liquidity

Many newer exchanges are merely using “white-label software” from a partner, which is borrowed software, limiting the trading functionality that they can provide. When an exchange uses a white-label solution, you don’t know who is getting your information.

OKCoin aims to cater to traders of all levels—from first-time buyers to institutional investors—with its range of features and tools, along with a clean and intuitive user interface. It’s also a highly fiat-focused platform, allowing onboarding from a variety of currencies.

Beginner traders can benefit from a low BTC withdrawal limit, meaning they can quickly and easily withdraw their crypto at any time.

However, OKCoin also provides various services for advanced and professional traders and institutions. It offers flexible settlement options, rebates on network fees, and incentives for market makers. There’s also a report center providing access to account and order history.

All traders benefit from lightning-fast trades through OKCoin’s world-class order matching engine. The platform also offers access to global liquidity through the 180 countries where it’s licensed and has permission to operate, including the United States and the European Union.

OKCoin is headquartered in San Francisco and operates eight local offices on three continents.

Trading cryptocurrency can be an inherently risky activity due to the notorious volatility of digital assets. However, users can offset many of the other risks by choosing an established exchange that excels in the areas that matter.

Share this article

OKCoin Brings on New Management in Bid for Global Expansion

Crypto Exchange OKCoin Opens Shop in Singapore, Adds SGD Onramp

CoinGecko Can Now Tell You Which Bitcoin Exchanges Are the Most Secure