You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team and edited by Bradley Keoun, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to.

Price Point

Bitcoin was up in crypto markets early Wednesday, bouncing after a 2.4% drop that appeared synced with a sell-off in U.S. tech stocks. Traditional markets also appeared to be pausing the recent retreat from risky assets.

The move down in digital assets has provided a “healthy reset after a fast and furious summer rally,” the cryptocurrency-focused investment firm Arca said Wednesday in a blog post. Bitcoin prices are still up about 42% year to date.

“This market still isn’t mature enough to absorb an increase of selling pressure from the market’s biggest investors,” Arca Chief Investment Officer Jeff Dorman wrote.

Market Moves

Bitcoin is suffering its worst two-week stretch since March, down 15% since the end of August, and anxious investors are once again scrambling to identify the 11-year-old cryptocurrency’s closest analog in traditional markets.

Is it a hedge against currency debasement, similar to gold? A disruptor of banks and the financial industry? A revolutionary innovation that should trade in line with tech stocks like Facebook, Amazon, Apple, Netflix and Google or even Tesla?

As the Federal Reserve pumped about $3 trillion of freshly created money into the global financial system this year in an effort to calm uneasy markets, the currency-debasement investment thesis garnered the most attention. Bitcoin outperformed the tech-heavy Nasdaq Composite index while trading broadly in line with the high-flying stocks.

But as tech stocks have tumbled over the past week, hit by concerns over frothy valuations and the revelation that the market might be buoyed by the Japanese conglomerate Softbank’s options buying, bitcoin sold off too.

“If you get a smash in markets then bitcoin’s not going to escape it,” Charlie Morris, chief investment officer of the digital-asset-focused investment firm ByteTree, said in a WhatsApp audio interview. “We’ve seen that time and time again, so why expect that to change?”

Longer term, bitcoin is likely to return to its outperformance, Morris predicts.

The high-flying tech-stock valuations “make no sense to anyone who’s a rational investor,” said Morris, who spent nearly two decades as a money manager for the giant British bank HSBC. “Bitcoin’s still small and has huge upside from here.”

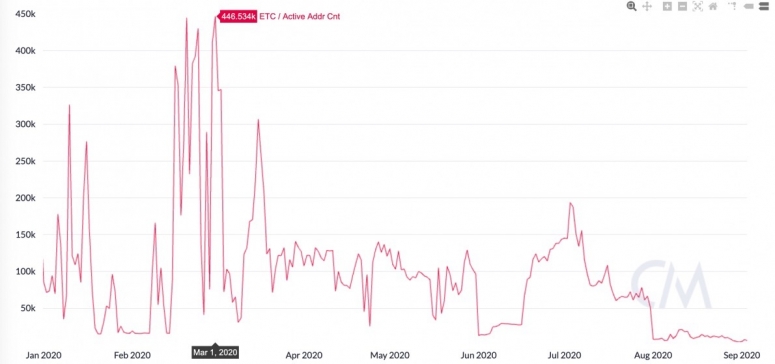

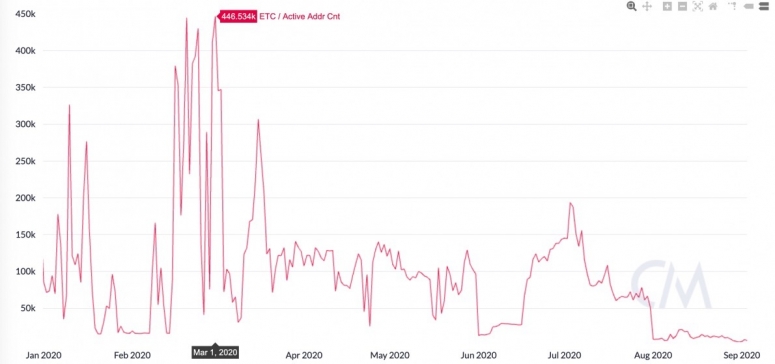

Crypto investors have ignored three straight 51% attacks on Ethereum Classic

For a blockchain network’s security, a “51% attack” is pretty much as bad as it gets. That’s when a single entity gains control of a majority of the network’s computing power, allowing it to siphon off extra units of the currency in what’s known as a double-spend.

So it would stand to reason that three successful 51% attacks in a month against the Ethereum Classic blockchain might dent investors’ confidence.

But as reported Tuesday by CoinDesk’s Muyao Shen, prices for the project’s native ETC token haven’t really taken a hit – a sign traders could be less concerned about security vulnerabilities than a quick profit in fast-moving cryptocurrency markets.

ETC has fallen about 27% in the past 30 days, not a terrible performance given that bitcoin is off by 15%.

For large networks like Bitcoin, a 51% attack is prohibitively expensive to do given the enormous amount of computational power — and electricity — required to pull it off. Ethereum Classic is much smaller, making it far more vulnerable.

“Many people are just sort of sitting on it,” Meltem Demirors, chief strategy officer at the digital-asset money manager CoinShares, told CoinDesk in a phone interview.

Bitcoin Watch

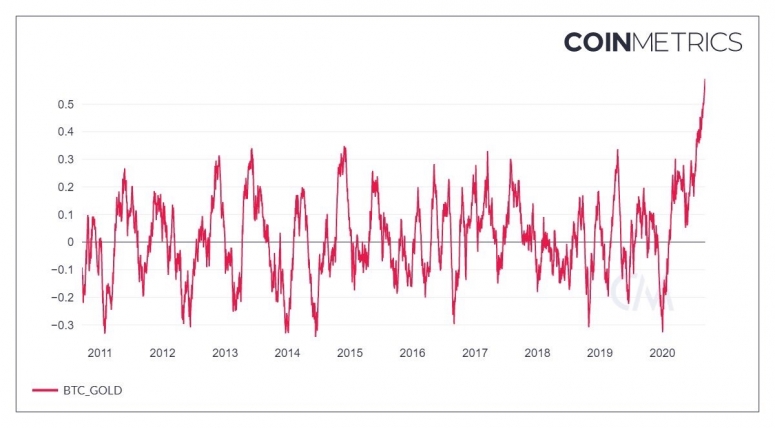

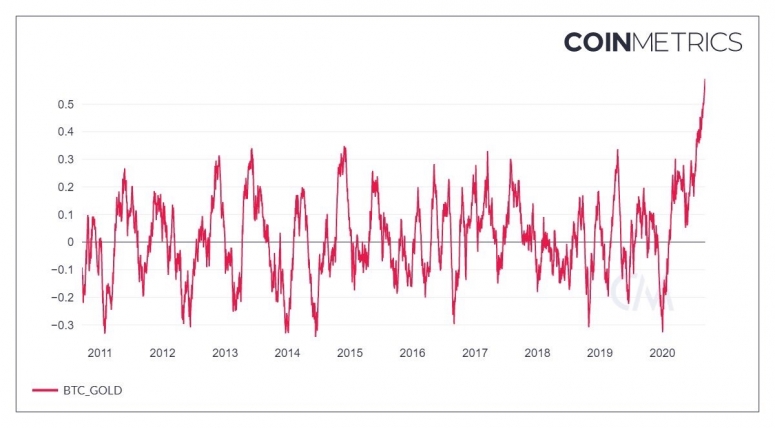

Bitcoin’s 60-day correlation with gold has risen to record highs above 0.5. With fortunes more tied to the yellow metal than ever, the cryptocurrency may now show greater resilience to risk aversion in stock markets.

- The leading cryptocurrency defended the $10,000 support for the fifth straight day on Tuesday even as Wall Street suffered losses.

- The persistent defense of key support, coupled with record miner confidence, as suggested by the hashrate and signs of dip demand suggests scope for recovery rally.

- “The recent drop represents overselling and buyers may soon step back in again,” Simon Peters, a crypto-asset analyst at multi-asset investment platform eToro, said in an email.

– Omkar Godbole

Token Watch

Orchid (OXT): The token, from the decentralized virtual private network developer Orchid Labs, was added as a member of the CoinDesk 20, replacing basic attention token (BAT).

Bitcoin (BTC): September is historically the cryptocurrency’s worst-performing month, with an average loss of 7%, a new Kraken report shows.

Yearn.Finance (YFI): “Intuitive interface to all DeFi” aims to be gateway that rookie yield farmers might grok, with deposit tokens that can be traded.

Ether (ETH): Hashrate approaches all-time-high as DeFi pushes up transaction fee rates, miner profits, Arcane Research says:

What’s Hot

Analogs

The latest on the economy and traditional finance

The stimulus deadlock will keep USD weak in the medium term: strategist (CNBC)

Germany ends China honeymoon with new Indo-Pacific strategy (Nikkei Asian Review)

China, HK stocks drop on Wall St tech woes, rising Sino-U.S. tensions (Reuters)

DoubleLine’s Gundlach predicts junk-bond defaults could double even as Fed props up valuations (Bloomberg)