Few brokerage apps have captured people’s attention like Robinhood Markets Inc. The Silicon Valley company has turned the complex process of trading stocks into a simple, free swipe across a screen.

But some behavioral researchers contend that that simplicity is turning investing into a game, and nudging inexperienced investors to take bigger risks.

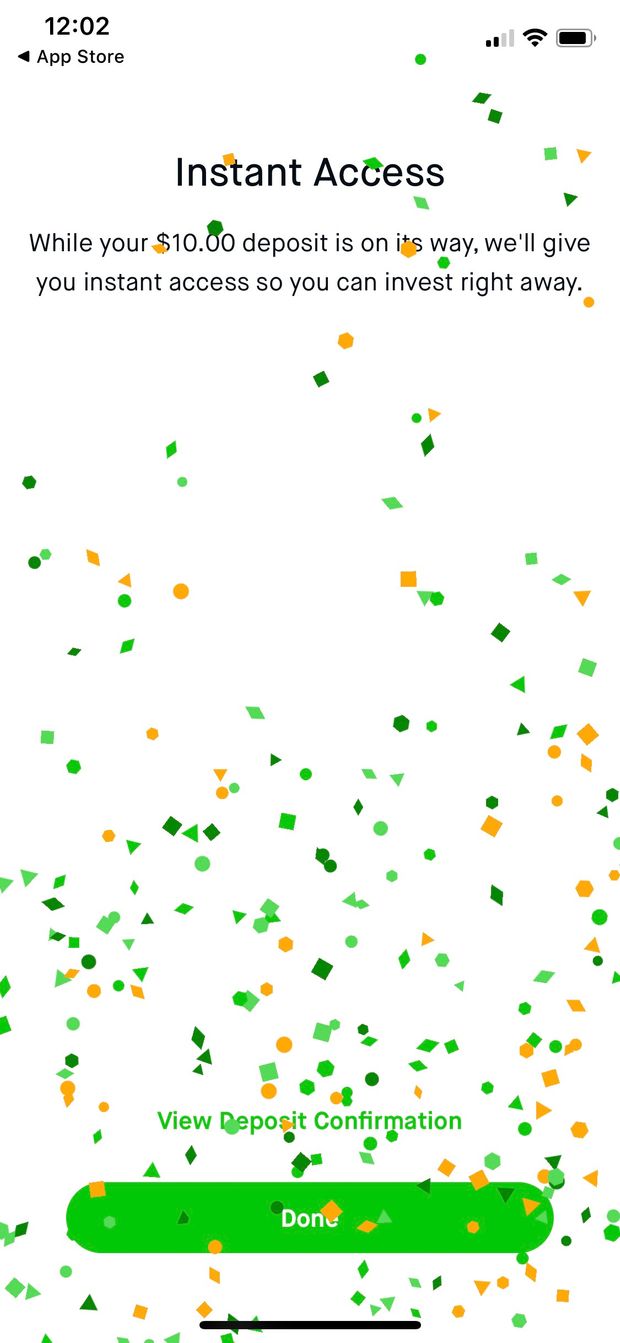

Robinhood and other newer trading apps such as eToro USA LLC and Webull Financial LLC inherit design elements from tech companies that influence user behavior to desired outcomes: Buy a product, use a service, view advertising. Traditional brokerage apps are stodgy. Robinhood blasts users’ screens with digital confetti and makes Netflix-style recommendations for stocks to buy. Buttons tapped to buy a stock are bigger and brighter than those for canceling a trade.

Such cues can exacerbate humans’ behavioral biases and can affect investing behavior, said Thomas Ramsøy, a neuropsychologist who is chief executive of Neurons Inc., an applied neuroscience company.

“If it feels right, we tend to go for it,” he said.

The Robinhood app is set in vivid colors. Its behavior incentives include giving users a trial run with free stock and making money instantly available to trade. Some cues nudge users to repeat certain behaviors and buy stocks based on what other people purchased.

Robinhood Chief Operating Officer Gretchen Howard said the app doesn’t gamify trading or encourage risky behavior. The company was founded with the purpose of erasing barriers to investing and provides a range of educational content on trading through its website, she added.

“We believe that broader participation in the markets is more democratic and can bring opportunities to many. Those who dismiss retail investors as gamblers or gamers perpetuate the myth that investing is only for the wealthy and highly educated,” Ms. Howard said.

“We built Robinhood to be a platform for customers to learn and invest responsibly, and most of our customers use a buy-and-hold strategy with their investments.”

A Robinhood spokeswoman added the brokerage doesn’t make recommendations to buy and sell securities.

The app shows users related stocks that other Robinhood users also own.

Robinhood’s minimal interface has proved to be a draw for younger investors. The brokerage boasts of having 13 million users who have a median age of 31, and was recently valued at $11.2 billion through a new fundraising round disclosed on Monday. The company doesn’t specify how many accounts are active.

Mr. Ramsøy, the neuropsychologist, said the simplified interface can have benefits: Reducing the amount of information visible on the screen can lower the amount of mental stress that can otherwise overload users, and help users make smarter decisions. Yet, he said, the nudges can work in the other direction to prod users into less rational decisions.

Lisa Silva started trading on Robinhood the way many people do: Her friend texted her a referral link. She and her referring friend received a free share for her efforts, choosing among three stocks displayed on what looks like a virtual lottery scratch card.

Robinhood says that its app’s 13 million users have a median age of 31.

“Robinhood is the gateway,” said Ms. Silva, who is 35 years old and lives in Ponte Vedra Beach, Fla., with her son.

Ms. Silva received a share of department store

Macy’s Inc.,

and she sold it soon after.

“I knew nothing about trading or the stock market. It really simplified it and was user-friendly from the beginning.”

Now, Ms. Silva spends as much as five hours a day researching and trading penny stocks on her iPhone.

For self-directed brokerages like Robinhood, user trading generates money for the companies even when trades are free.

Marshini Chetty, an assistant professor of computer science at the University of Chicago specializing in human-computer interaction, said Robinhood’s interface shares characteristics of what the software industry calls “dark patterns”—a design choice that steers users down a desired path.

For instance, once you start a trade on Robinhood, it is easier to move forward than to back out of it.

SHARE YOUR THOUGHTS

Would you consider trading on Robinhood? Why, or why not? Join the conversation below.

While confirming the purchase requires a swipe up, there is no clear cancel button. To back out of a trade, the user has to press a link labeled “edit” on the top-left corner and then press an X button.

At rival Webull, users are presented with a “confirm” button to proceed with a trade and an X above that would cancel it. Webull also shows users a toggle to skip confirmations in the future.

But on apps from more traditional brokerages, such as

Charles Schwab Corp.

and

E*Trade Financial Corp.,

trade confirmations include labeled options to either place the order or cancel it.

Robinhood prompts users to transfer money from their bank accounts and ensures deposits of as much as $1,000 are immediately available for trading—a feature also available on Webull. Schwab, by contrast, takes at least one business day to clear funds and allow users to start trading.

Robinhood offers a trial run with free stock.

“It’s important to distinguish between accessible, modern design and gamification,” Ms. Howard said. “The incentives we offer, such as free stock, give people a chance to learn about investing and companies.”

All brokerages are incentivized to encourage users to trade. They earn money by sending customer orders to trading firms, which execute them. The practice, called payment for order flow, is controversial but legal in the brokerage industry, helping make commission-free trading possible. While customer orders must be executed at the best-available price, trading firms have many ways to use the trades to their advantage, including to mask larger buying and selling by the firm or its clients.

Robinhood made more than $270 million from selling order flow in the first six months of the year, according to securities filings that were compiled by Piper Sandler analyst Richard Repetto. Schwab made roughly $120 million, while E*Trade pulled in about $190 million.

TD AmeriTrade Holding Corp.

topped those three, earning more than $525 million.

“Receipt for order flow is a common, legal and regulated industry business practice,” the Robinhood spokeswoman said.

After Ms. Silva’s initial Robinhood deposit, confetti rained down across her screen, congratulating her.

“It makes people think they’re winning,” Ms. Silva said of the graphic.

The confetti graphic has become a Robinhood signature, finding its way into company advertising. “The animation marks a milestone moment,” said Robinhood’s Ms. Howard, who added that confetti isn’t displayed on every trade or deposit.

Getting into Robinhood is far easier than getting out. Transferring accounts to another brokerage takes as long as a week, which is common in the brokerage industry. Ms. Silva, who moved most of her activity to rival Webull, still keeps trading penny stocks in her Robinhood account because she fears their prices could swing too much during the time it takes to transfer them.

Webull offers data on short sellers, as well as a social-media feed similar to Twitter.

Webull, founded in 2017 and based in New York, features a more sophisticated interface and more trading options than Robinhood, including data on short sellers, wider trading windows and a social-media feed similar to

It also employs bright colors and graphics touting promotions to its roughly 750,000 daily active users, who are mostly in the U.S.

A recent promotion, Webull’s Summer Referral Competition, pits users in a referral race for free shares in technology stocks

Facebook Inc.,

com Inc.,

Apple Inc.,

Netflix Inc.

or Google parent

Alphabet Inc.

A leaderboard, similar to what people see in videogames and contests, shows users where they stand.

“We are successfully utilizing peer marketing that is extremely popular with our millennial user demographic,” a Webull spokesperson said.

Another rival, eToro, offers cryptocurrency trading in the U.S. and plans to start trading stocks next year. It gives $50 for each referral and to new users.

The platform, which has 14 million users around the world, gives users the option to copy trades made by other people, said Guy Hirsch, eToro’s U.S. managing director. About one-eighth of its U.S. users use the service, which is aimed at traders who don’t have the time to do their own research or are new to investing.

Users with enough copycats are eligible to earn 2% of the total money that is copying them, he added.

“Behavioral research and design elements can also play a positive role in educating retail investors about investing and risks,” an eToro spokeswoman added, “as well as preventing undesired outcomes such as losing more than one has.”

Write to Michael Wursthorn at [email protected]

Copyright ©2020 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8