Cryptocurrency exchanges are online platforms where one can buy, sell, or trade cryptocurrencies. The aim of crypto exchanges is to connect buyers and sellers by creating a cycle of supply and demand in one place.

Centralized vs Decentralized Exchanges

However, almost every exchange is prone to hacking, has privacy issues, and users could end up losing their funds. Non-custodial exchange services look to overcome these shortcomings of cryptocurrency exchanges.

Online cryptocurrency exchanges can be categorized into two types: centralized and decentralized.

Centralized exchanges allow you to sign up with your email and password and usually have extra security features like two-step authentication or email verification.

Even though they make it easier for everyday users to buy and sell digital assets with their interactive interface, one major downside of such exchanges is that they do not give users full control of their cryptocurrencies. The private keys of your wallets are held with the exchanges, so if they were to get hacked, your funds will be lost.

Decentralized exchanges (DEXs) give users more control over their assets as they only act as intermediaries and do not store private keys giving the users full control of their funds. However, these exchanges come up with their own drawbacks such as low liquidity, slow UI, and not being able to handle huge amounts of transactions, etc. There are a very few DEXs compared to CEXs owing to the difficulty that users face while using the former due to complex UI. This is where an instant crypto exchange comes in – users can instantly trade their digital currencies in just 3 simple steps without the hassle of needing to register or worrying constantly about security.

Generally, people prefer CEX over a DEX because of a number of reasons like liquidity, volume, user-friendly platforms, etc. Top centralized exchanges like Bitfinex, Bittrex, Coinbase, Kraken, Binance, Huobi have 99% of the transaction volume and were the first to exist in the market even before the idea of decentralized exchanges came up, so they have an upper hand of being in the market since inception.

Drawbacks of cryptocurrency exchanges

Cryptocurrency exchanges come with their own set of disadvantages, the major drawbacks include:

Privacy: Exchanges store all your information such as IP address, email, and details about your transactions which basically doesn’t leave behind much privacy for you.

Data Breaches: With increased KYC/AML policies by exchanges due to local regulations, security breaches have risen sharply. In fact, over 10000 Binance users’ personal data was stolen in 2019 with the hacker demanding 300 BTC threatened to release the photos which included driving licenses, passports, and face scans of users.

Loss of funds: The majority of the exchanges have had a story of getting hacked and users losing their hard-earned money. The bigger picture is explained in detail in the next paragraph.

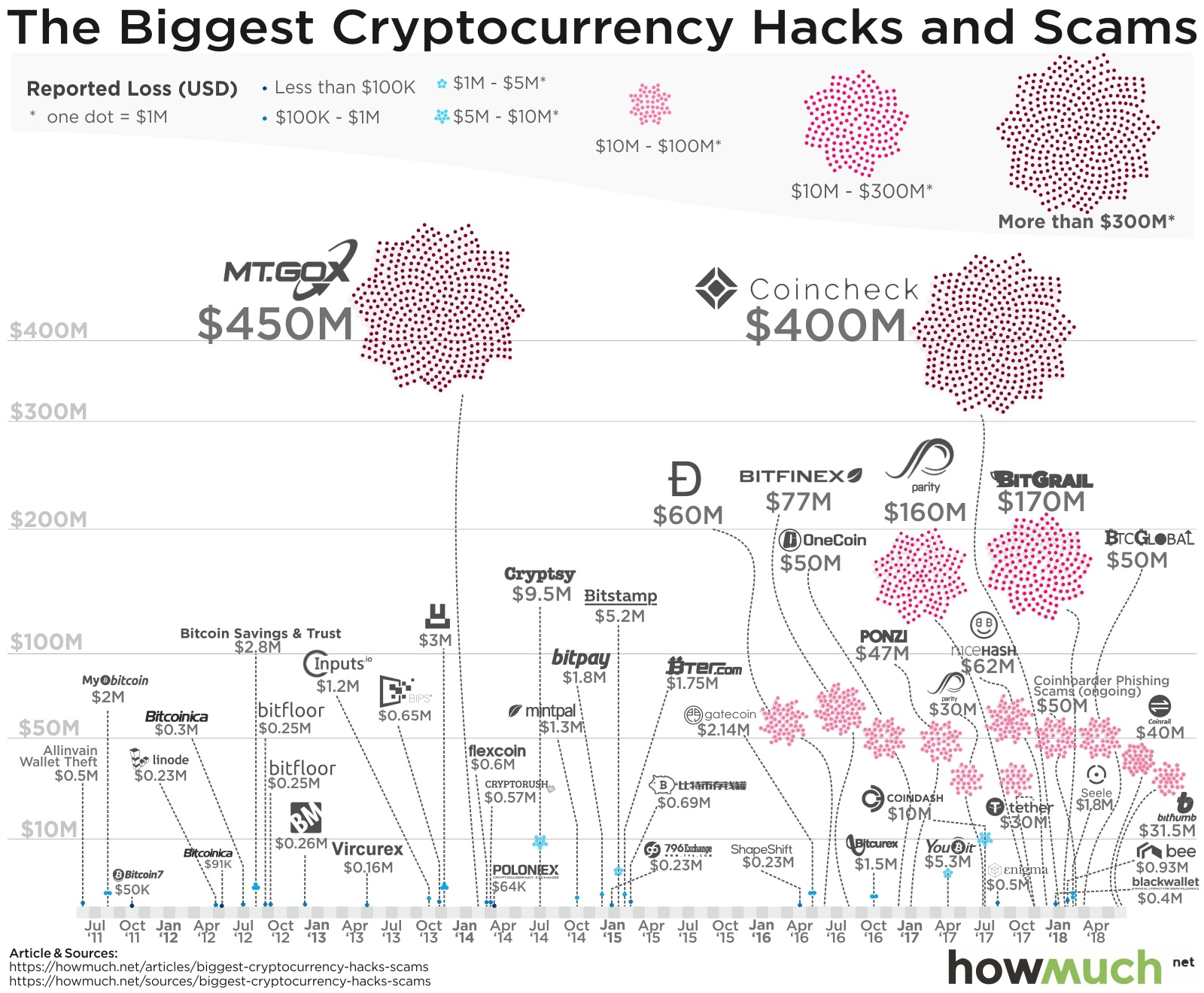

The cumulative money lost from just the top three biggest exchange hacks in the last 7 years is over 1 Billion US Dollars, now imagine what the figures would look like if we consider all the hacks. Below is a picture that summarizes the money lost in all major hacks until April 2018.

Source: https://howmuch.net/articles/biggest-crypto-hacks-scams

The world’s biggest cryptocurrency exchange in terms of daily volume, Binance, which is known for its innovative products and strong leadership went through a security breach in May 2019 which resulted in 7000 Bitcoins being stolen from their platform. Even though all the affected customers were reimbursed in this case, it shows how vulnerable it is to leave your money on exchanges.

“Your keys, your Bitcoin. Not your keys, not your Bitcoin.’’

– Andreas Antonopoulos, Bitcoin and security entrepreneur

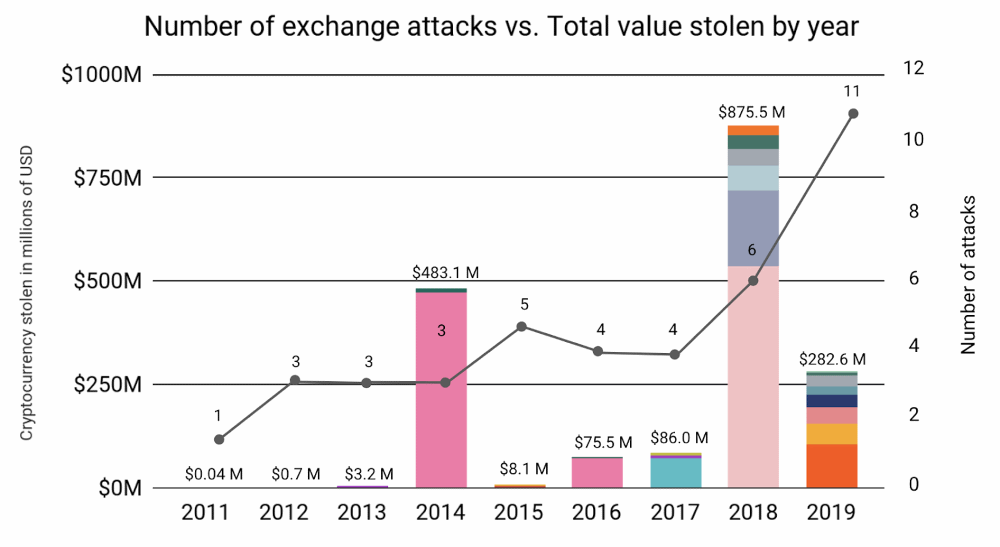

Source: Chainalysis

Cryptocurrency traders and enthusiasts started trending hashtags such as “ProofOfKeys” on Twitter after major exchange breaches to ensure investors and traders stay away from custodial wallets and not store their cryptocurrency on exchanges unless they are trading. Non-custodial cryptocurrency exchanges and wallets started to gain traction as users gave much more priority to their security.

Also, trading on exchanges is not only risky but also a tedious task. In order for you to trade on a DEX, you need to enter your private keys or Keystore or use MetaMask; the latter is the most recommended method. Then you need to send your digital currency from your private wallet to Metamask and then to DEX. Every transaction has to be signed by you. Probably the most frustrating part of using this type of exchange is you have to wait until someone buys or sells so that your order fills, which can take a long time depending on the liquidity on that exchange.

CEXs solve this waiting problem by using market makers, but again, users are required to log in and perform authentication to trade and confirm by email to make every withdrawal. On top of all this, all exchanges require you to do KYC to comply with local regulations, which can take days.

Overcoming CEXs’ and DEXs’ drawbacks

Instant crypto exchange services that require no registration and perform your transactions fast may be the solution. These platforms give you basically as many options as any regular exchange – but overcome their shortcomings.

Another major advantage of such platforms over CEXs and DEXs is that they do not control your funds at all – as non-custodial services, they allow you to keep the keys to your crypto privately. An as there’s no registration required, the crypto exchange is very simple here. For example, on ChangeNOW, all you have to do to buy Bitcoin is to enter the amount of the sum you want to exchange, your wallet address, and to click Confirm.

Along with this, there are several other features that widen the possibilities of a trader on ChangeNOW. For example, they have no upper limits for the crypto exchange; over 200 cryptocurrencies are supported, and it’s possible to buy them with Visa or MasterCard. The rates are very reasonable as the service claims it uses special algorithms that pick the best rate at the moment of the exchange.

So what’s the best place to trade crypto?

Of course, there is no ideal platform to trade crypto out there. ChangeNOW has its own drawbacks – they have no crypto-to-fiat options available, and fiat-to-crypto exchanges are a bit pricy. Many traders consider instant exchange services the best place to trade crypto with security and convenience – but we recommend you doing your own research to choose the best platform that will fit your needs.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Changenow.io

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer