Congestion on Ethereum has yet again led to high transaction fees and inconsistent confirmation times that can be deemed as unacceptable in any point in time in the history of commerce, let alone at a time where technology and competition has afforded users better options.

We have been pointing out that Eth was dead man walking years ago…only BSV scales. Anyone still on Eth is just stupid at this point. Its .00002 US for one transaction on BSV and as it scales this will drop and you can get discounts from Taal for bulk.

— Calvin Ayre (@CalvinAyre) September 3, 2020

More at eleven.

It is clear that anybody that has chosen to build on Ethereum can only fall into one of two categories: either disingenuous with no intention to add value in the real world, or naively they have not put in enough thought into how they will be able to grow their business long term by default since ETH is already not able to handle its current level of transaction volume so the scope of customers a project can attract is limited at best.

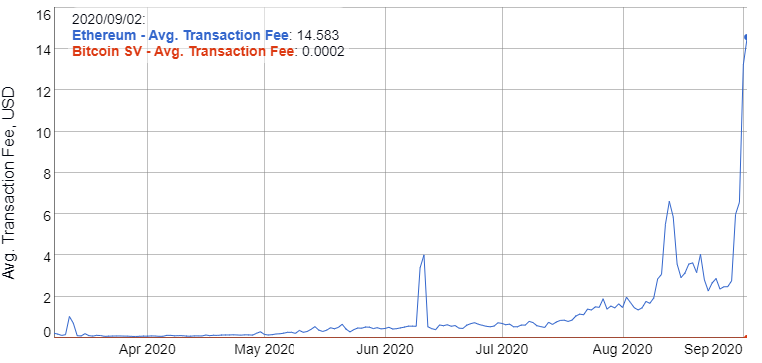

The fees have been steadily rising on Ethereum for the entire year, topping an average of $14 per transaction during September 2020 before the ‘DeFi’ fee explosion this week that saw fees spike over $100 per transaction. In comparison, Bitcoin SV has averaged about 1/50th of a cent consistently during the year and continues to be cheaper the more it scales.

Source: BitInfoCharts

Scale is not a unique term to blockchains, it is always the question that any serious business will ask themselves if they want to move beyond the reach of the current scope of operations, with resource, time, cost constraints that their current reach has and expanding this all whilst increasing margins and keeping costs down.

It doesn’t matter about the quantity of ICOs, tokens or DeFi projects there are on Ethereum. Those that have chosen Ethereum have up until this point not thought far ahead or big enough and have already locked themselves into a dead end.

Let’s compare the metrics of the two blockchains that have the highest transactional usage and how they stack up.

ETH | BSV | |

Market Cap | 36 Billion (2nd) | 2.9 Billion (10th) |

Price | $402 | $159 |

Total Supply | No hard cap | 21 million cap |

Block size limit | 8,000,000 GAS | Unlimited |

Tx/second maximum capability | 30 | 10000+ |

Instant transactions (zero confirmation) | No | Yes |

Total transactions in 2020* | 194,777,635 | 142,961,696 |

Maximum transaction on a single day in 2020* | 1.2 Million | 5.5 Million |

Average daily transactions in 2020* | 788,573 | 578,792 |

Average cost per transaction in 2020* | 1.83 USD | 0.00035 USD |

Median cost of transaction fees in 2020* | 0.79 USD | 0.0001 USD |

*Data is for the period of January 1 2020 – September 3rd, 2020 at the time this article was published. (Source: Blockchair)

It’s a nice utopian narrative that there will be many blockchains that can co-exist all doing similar functions and that irrespective of things like speed and costs, that users will continue to be ideologically driven to a name or a community.

This is a fallacy. At the end of the day the end user of your product will not care about hobbyist ideologies, they will not tolerate burning through money for inconsistent confirmation times.

Businesses, enterprises and users all need certainty in commerce. All types of users in commerce want to have lowest cost and have the guarantee that the transaction will be processed in an acceptable service level agreement according to the needs of the goods or services they are providing.

The combination of speed and cost is what ultimately accelerates velocity of usage, not one or the other. Certainly not neither.

The promises of better scaling solutions like Ethereum 2.0 that are ‘coming’ are a match made in heaven for the scam ICOs and scam DeFi projects that have caused the bottlenecks of the network in the first place. Filled with empty promises that only serve to buy more time to kick the can down the road. You could say in some ways, the Ethereum protocol and the projects that have been built on it subserve each other to keep the illusion going longer.

However for any serious businesses or developers out there that have fallen into this trap, Bitcoin SV is technically superior in every way vs Ethereum. BSV currently has real unbounded scaling, several magnitudes cheaper transactional fees and higher transactional throughput capability thousands of times more than that of Ethereum.

Bitcoin SV has broken records on several occasions this year. The biggest block so far has been a 369-megabyte block which had over 1.3 million transactions. BSV has proven that it can handle various types of transactions from micropayments which are barley fractions of a cent to handling large data storage, to anything in between.

With the Ethereum ship hitting the iceberg, the life boats remain largely vacant for now. If there is an analogy that we can tie back to the current events on the Ethereum network, it is that the positions on the lifeboats to evacuate will ultimately reach capacity and delaying your spot could come at an enormous cost.

That must mean that anyone that willingly chooses to stay on the sinking Ethereum ship must believe in the back of their minds that they are capable swimmers that can survive in the harshest conditions of the stormy Atlantic Ocean.

New to Bitcoin? Check out CoinGeek’s Bitcoin for Beginners section, the ultimate resource guide to learn more about Bitcoin—as originally envisioned by Satoshi Nakamoto—and blockchain.