$ETH #Ethereum #Crypto #Cryptocurrencies #Trading

Ethereum News

Decentralized finance (DeFi) has been hindering the Ethereum network, but not in the way most analysts would have guessed.

An architectural quirk in the most-used software version of Ethereum, Geth, has led to an uptick in the practice of spamming the network to secure trade profits over the last six months, according to Certus One co-founder Hendrik Hofstadt.

Transaction spamming is one of several reasons the average Ethereum user fee has increased some 800% since may, according to Coin Metrics. Ponzi schemes like MMM or DeFi’s general growth in 2020 are also to blame.

The algorithmic trading companies have created bot swarms to look at the Ethereum transaction queue (called the mempool). These bots wait for large trades on DeFi platforms such as Uniswap. after they go through, the bots quickly place orders to take advantage of price movements in what is referred to as “backrunning.”

Too many companies knew about this practice, though. So some companies switched up their techniques over the spring months by sending a wall of executions to crowd out others and secure a backrun order.

For trading companies, this translates into additional fees overall but arbitrage profits into the hundreds of thousands, according to addresses provided by Hofstadt.

For the network, spamming crowds out other transactions. It also increases the typical fee for everyone.

On July 29, the Geth team approved swapping the execution model to a first come, first served basis. Yet, it remains to be seen if mining companies will update to the new Geth version.

Miners could keep doing business as usual if they value the extra pocket change from DeFi traders more than helping out the network in general.

Indeed, total network fees per day on Ethereum has accumulated 1,077% since may 5 from $162,200 to $1,909,000 on a seven-day rolling basis, according to Coin Metrics.

Technical Indicators

Overall, the bias in prices is: Upwards.

Note: this chart shows extraordinary price action to the upside.

By the way, prices are vulnerable to a correction towards 304.23.

The projected upper bound is: 429.50.

The projected lower bound is: 371.41.

The projected closing price is: 400.45.

Candlesticks

A black body occurred (because prices closed lower than they opened).

During the past 10 bars, there have been 6 white candles and 4 black candles for a net of 2 white candles. During the past 50 bars, there have been 31 white candles and 19 black candles for a net of 12 white candles.

Momentum Indicators

Momentum is a general term used to describe the speed at which prices move over a given time period. Generally, changes in momentum tend to lead to changes in prices. This expert shows the current values of four popular momentum indicators.

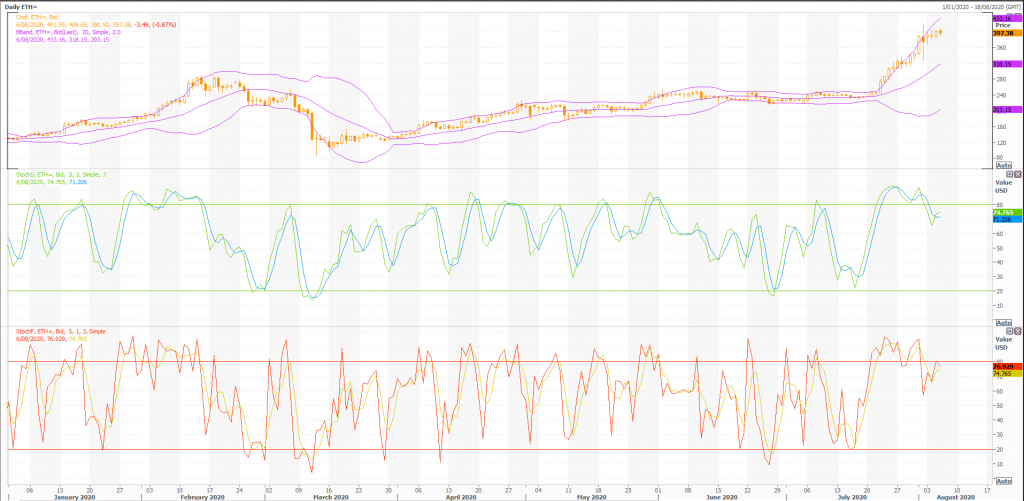

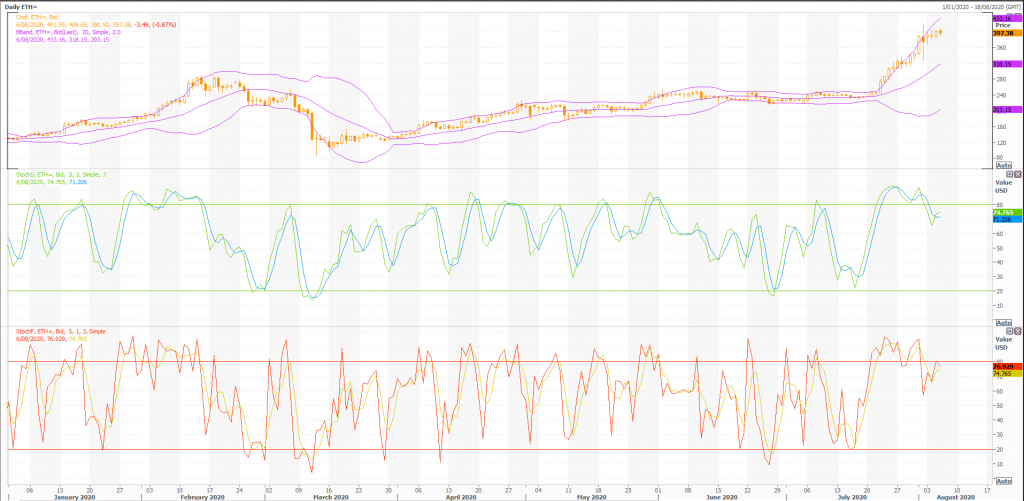

Stochastic Oscillator

One method of interpreting the Stochastic Oscillator is looking for overbought areas (above 80) and oversold areas (below 20). The Stochastic Oscillator is 74.6744. This is not an overbought or oversold reading. The last signal was a sell 4 period(s) ago.

Relative Strength Index (RSI)

The RSI shows overbought (above 70) and oversold (below 30) areas. The current value of the RSI is 82.20. This is where it usually tops. The RSI usually forms tops and bottoms before the underlying security. A buy or sell signal is generated when the RSI moves out of an overbought/oversold area. The last signal was a sell 56 period(s) ago.

Commodity Channel Index (CCI)

The CCI shows overbought (above 100) and oversold (below -100) areas. The current value of the CCI is 102.This is an overbought reading. However, a signal isn’t generated until the indicator crosses below 100. The last signal was a sell 27 period(s) ago.

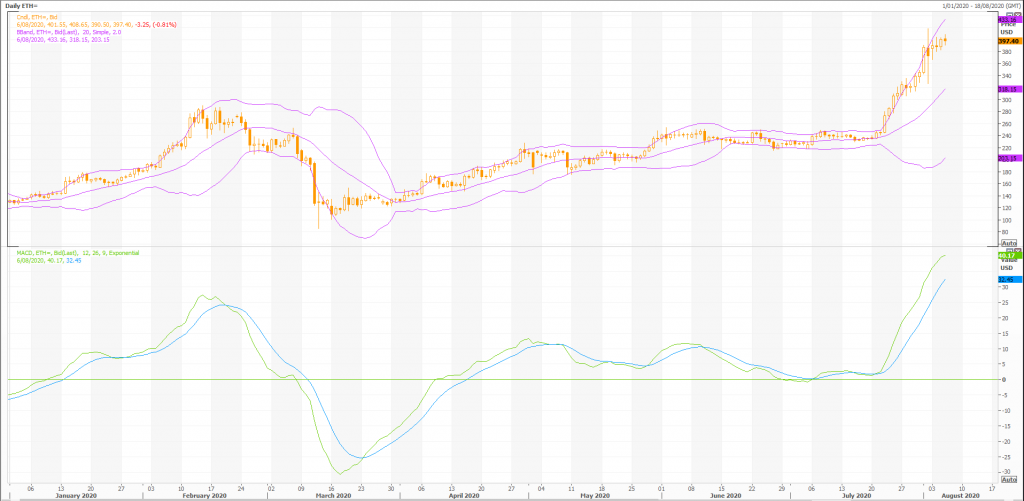

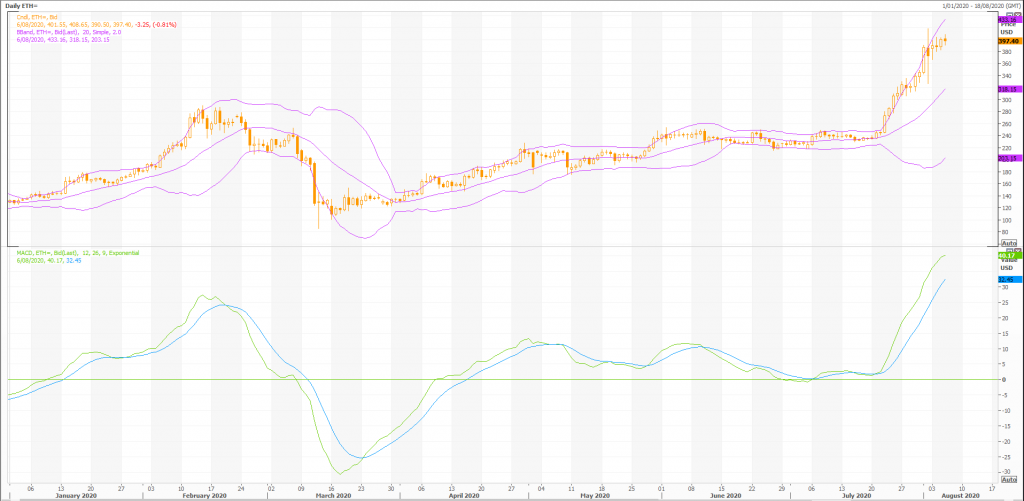

MACD

The Moving Average Convergence/Divergence indicator (MACD) gives signals when it crosses its 9 period signal line. The last signal was a buy 15 period(s) ago.

Rex Takasugi – TD Profile

FOREX ETH= closed down -3.520 at 397.130. Volume was 12% below average (neutral) and Bollinger Bands were 319% wider than normal.

Open High Low Close Volume 401.550 408.650 390.500 397.130 319,877

Technical Outlook Short Term: Overbought Intermediate Term: Bullish Long Term: Bullish

Moving Averages: 10-period 50-period 200-period Close: 366.27 267.28 214.59 Volatility: 77 62 105 Volume: 1,157,798 445,897 361,681

Short-term traders should pay closer attention to buy/sell arrows while intermediate/long-term traders should place greater emphasis on the Bullish or Bearish trend reflected in the lower ribbon.

Summary

FOREX ETH= is currently 85.1% above its 200-period moving average and is in an upward trend. Volatility is high as compared to the average volatility over the last 10 periods.

Our volume indicators reflect very strong flows of volume into ETH= (bullish). Our trend forecasting oscillators are currently bullish on ETH= and have had this outlook for the last 26 periods. Our momentum oscillator is currently indicating that ETH= is currently in an overbought condition.