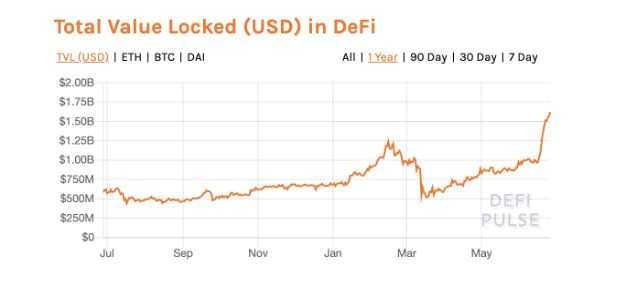

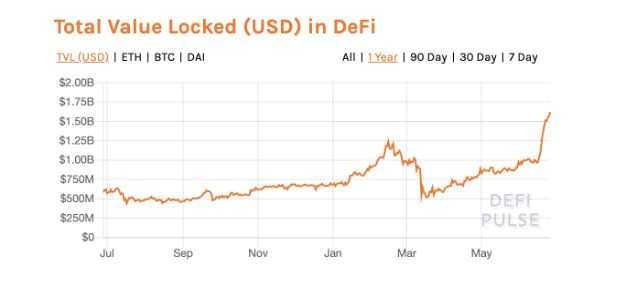

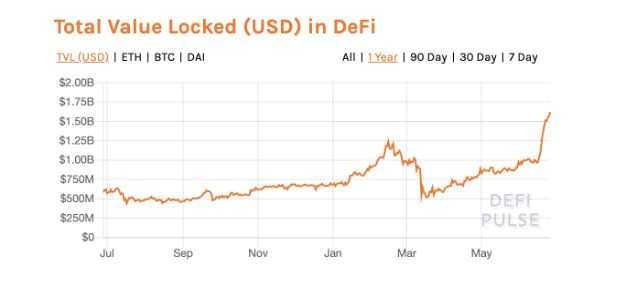

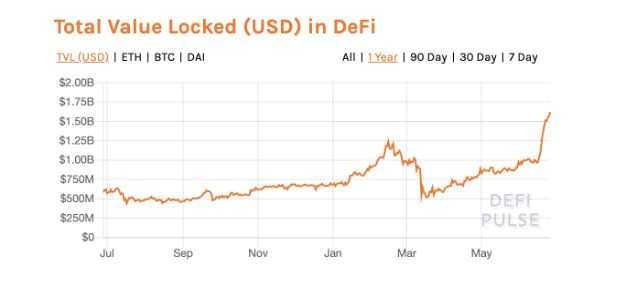

The financial world is changing at a pace never before seen in history. These new instruments are being developed and made available to anyone willing to explore the space and to serve a wide variety of needs. Investment in Decentralised Finance (or DeFi) has spiked to 1.5bn USD in assets locked. These assets are in the form of digital tokens called cryptoassets and have many of the same properties as those found in more familiar financial markets.

This is all happening against a backdrop of traditional financial markets operating in a very strange state. Across the globe interest rates on savings accounts are dismal or negative, and the bond market is turning negative on a regular basis. Inflation is eating away at everything.

So what is Defi exactly?

In broad terms DeFi products and services look to achieve similar outcomes to those that exist today in the traditional financial world. Common examples include stable currencies, collateralized loans, bonds, interest rate swaps and so on. The key difference is that they do not rely on institutions to act as trusted third parties. All the trust lies within the complex, but transparent, code and mathematics that make up the blockchain and smart contracts knitting the ideas into the technology.

Can you give me an example of a DeFi market?

Consider a money market that allows you to earn interest or borrow assets against collateral. In the traditional world your collateral could be a house and a home improvement loan could be the borrowed assets. For many people arranging this loan would be a lengthy process of filling in forms and providing legal documentation covering ownership.

Not so in the DeFi world. Remember that everything is treated as a cryptoasset which already has value and ownership by definition. All that is required is to transfer some control of the cryptoasset into a smart contract to act as collateral for a loan. On the strength of the value of that deposit, new cryptoassets in the form of a cryptocurrency can be minted (just as a bank creates new money when issuing a loan).

An example would be putting down ETH (the primary cryptoasset of Ethereum) as collateral to obtain DAI (pronounced “dye”) – a cryptocurrency pegged to the value of USD. This efficiently removes the volatility of earlier cryptocurrencies which would suffer wild swings in value making pricing difficult for merchants. Accepting DAI eliminates that issue while retaining all the benefits that cryptocurrencies offer (finality, reduced fees, fraud reduction etc).

I’ll need a quick reminder about blockchain and smart contracts…

Blockchain technology relies on digital tokens, formally called cryptoassets, which can change ownership in a trustless manner. The ownership is tracked using a special kind of distributed database so that everyone can agree on who owns what (with varying degrees of privacy).

The most advanced blockchains support smart contracts which allow cryptoassets to be programmable, meaning you don’t need a huge middle or back office to settle, clear and manage breaks. Smart contracts should make the most complex of financial products as easy as sending an email.

Ethereum is by far the largest blockchain-based smart contract ecosystem in the world and is currently undergoing a significant parallel upgrade to its core infrastructure to transition to Ethereum 2. Many of the largest DeFi markets operate using Ethereum as their platform.

It sounds like Ethereum is already winning DeFi why the need for Ethereum 2?

At the time of writing Ethereum 1 is secured using a Proof of Work mechanism which is quite time and energy intensive and therefore limiting. You can think of it as moving from the old days of dial up modems into the modern age of fibre optics to the home and all the new services that upgrade enabled (imagine Netflix on dialup instead of broadband!).

Ethereum 2 uses a more efficient security mechanism called Proof of Stake. This greatly increases the transaction throughput and, in combination with various other scaling solutions, enables Ethereum 2 to exceed the transaction throughput of traditional financial networks.

Proof of Stake requires stakers to provide funds as collateral and validate the integrity of transactions on the network. Dishonest validators will have their collateral confiscated (slashed) but honest validators will be rewarded with interest payments in ETH. This makes for a compelling value proposition as the yield curve ranges from 18% to around 5% over a 3 year period. This is in addition to any increase in the underlying value of cryptoasset on the open markets.

Where can I learn more?

A good introduction to Ethereum can be found on the official Ethereum Foundation website.

Sites such as defipulse.com or defiprime.com track the latest activity and vlogger Chris Blec has some great videos showing you how to explore and experiment with these tools.

Always keep in mind that many of these tools are currently prototypes – there is no insurance for your losses – but there are potential gains to be made if you are willing to put the effort in to learn.

This article was written by Attestant.io. We have designed, and developed a non-custodial, institutional-grade, managed staking service for individuals, and entities with >32 Ether.

For more information, please read our technical posts on Ethereum 2 staking.

Attestant Limited is registered in England and Wales under company number 12540798 at 7 Albert Buildings, 49 Queen Victoria Street, City of London, EC4N 4SA, Great Britain.