The Past Week, In A Nutshell

What Happened: “It’s certainly been a wild ride for stocks in 2020,” noted researchers at LPL Financial. “Barely past the halfway point, the year has already brought the worst pandemic to hit the U.S. in over 100 years, an unprecedented government-induced recession as much of the country was locked down, some stomach-churning market volatility, and massive, unprecedented stimulus from policymakers totaling several trillion dollars”

Remember This: “U.S. companies are about to give us a look into their worst quarter since the Great Financial Crisis,” suggested Lindsey Bell, Chief Investment Officer for Ally Financial’s (NYSE: ALLY) Ally Invest. “Second-quarter earnings reports may not be pretty. But expectations for next year have stabilized. If investors stay more focused on next year’s earnings estimates than next week’s, the market will likely keep its head above water.”

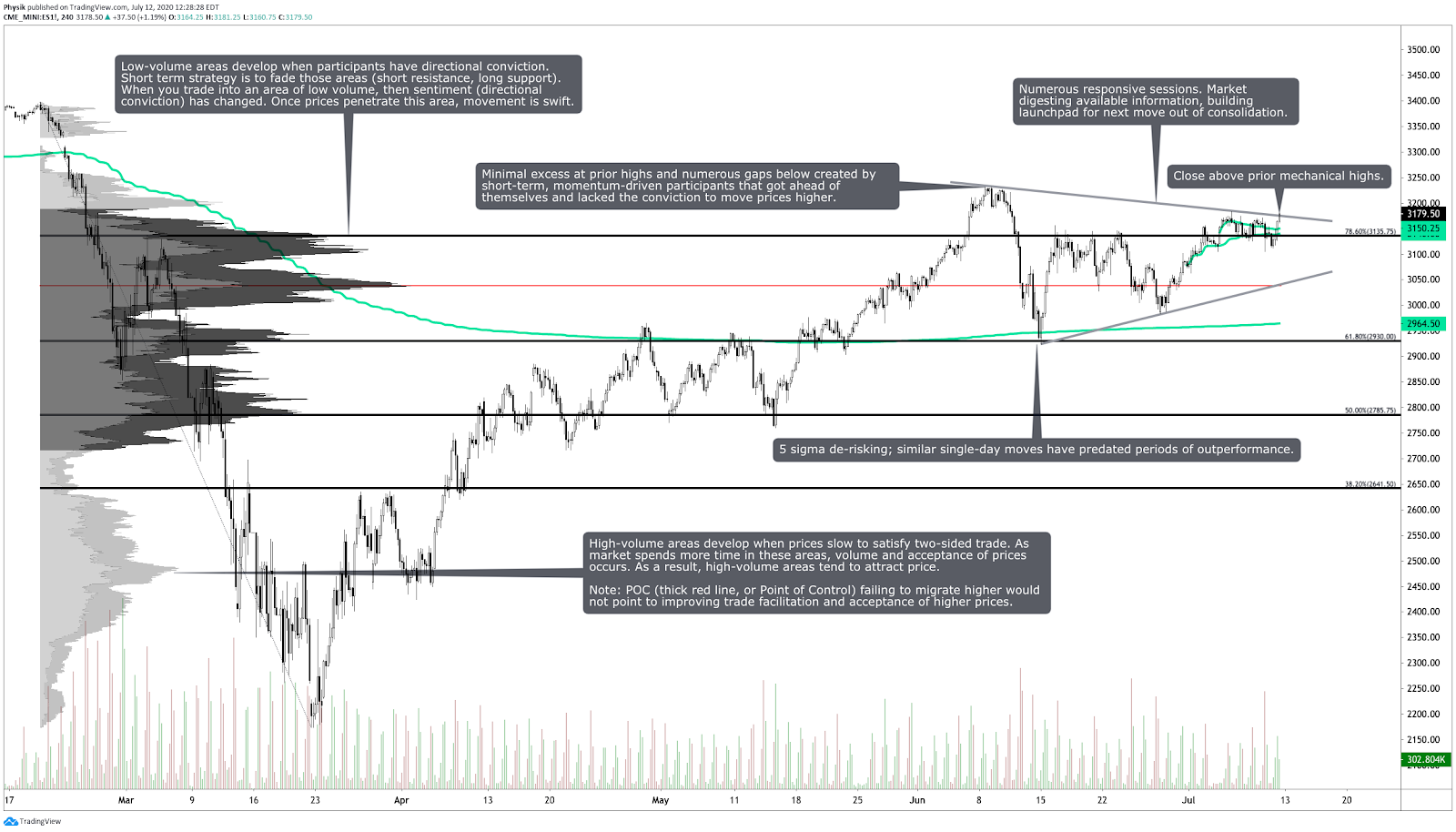

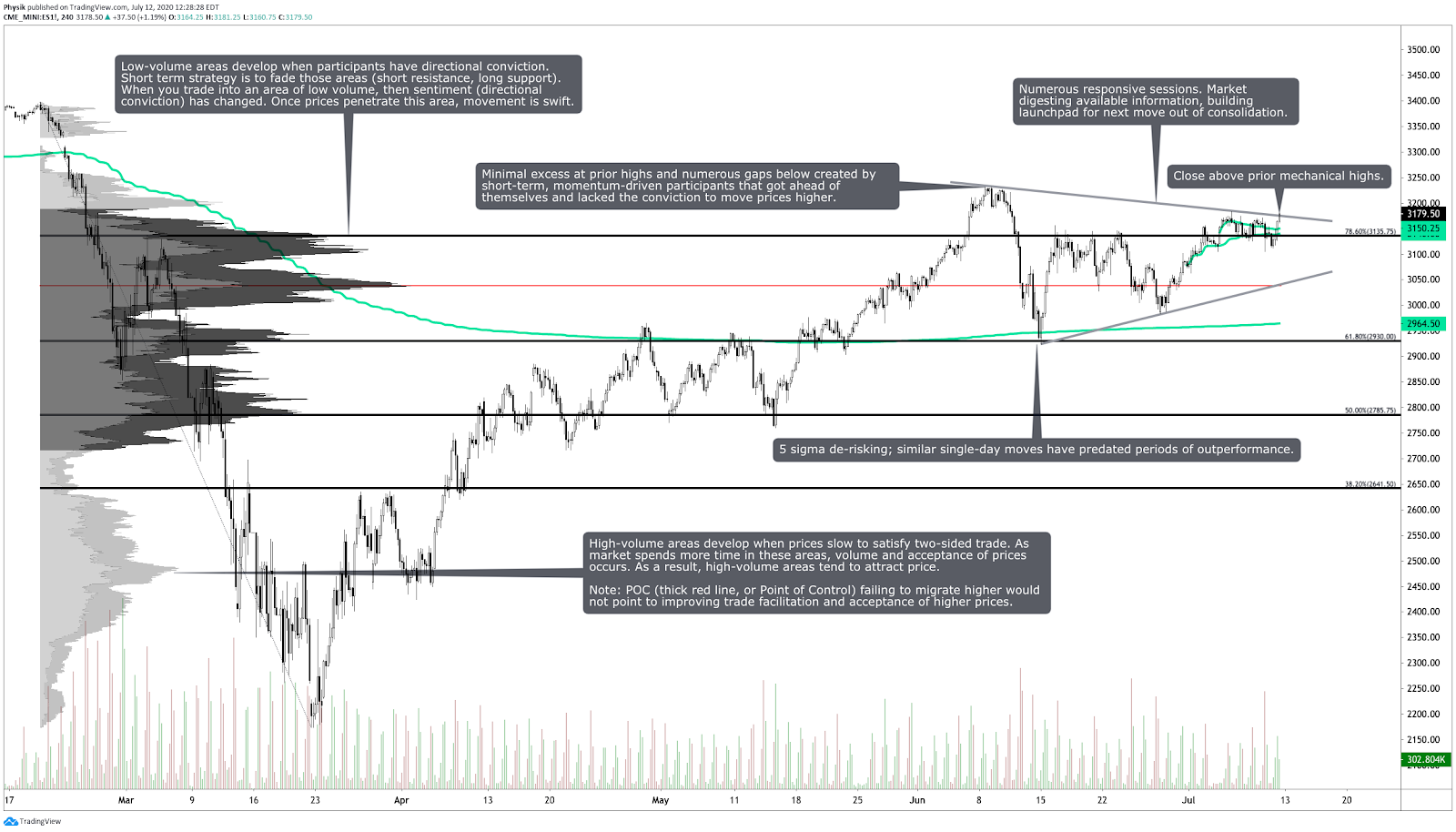

Pictured: Profile chart of the S&P 500 E-mini Futures

Technical: Broad-market equity indices balanced last week, evidenced by the responsive, tight trading range.

Recapping Last Week’s Action: On Monday, the S&P 500 traversed higher and left minimal excess before balancing into the close. Tuesday’s session made an attempt for Monday’s high, near $3,180, but sold off, leaving value higher and closing just below the overnight low.

After a quick morning liquidation, Wednesday’s session rejected prices in the lower part of the balance area and left value overlapping, with a close at the highs. Thursday responded lower, after a quick push to the $3,170 area of resting liquidity, to and through a low volume area and the prior day’s low, before squeezing back into range.

Despite the high gamma expiration suggesting many names could pin, Friday opened up around a composite high-volume area, within range, and attempted lower, before responding back through the open, and repairing earlier weak highs.

Looking beyond broad market indices, the innovation-driven, technology-based sectors are extremely extended while relatively weak sectors, such as energy and financials, have found it hard to come by support.

Overall, the market is at an important level and will likely, based on its reaction to Friday’s close, experience volatility in the coming sessions.

Scroll to bottom of this story to view non-profile charts.

Key Events: Federal Budget; NFIB Business Optimism; CPI; NY Fed Manufacturing; Industrial Production; Initial Claims; Retail Sales; Business Inventories; NAHB Housing Market Index; Building Permits; Housing Starts.

Fundamental: In light of extremely accommodative policies, investors should feel optimistic.

- United Airlines Holdings Inc (NASDAQ: UAL) may furlough 36,000 staff.

- Rivian raised $2.5B led by T. Rowe Price Group Inc (NASDAQ: TROW).

- Economic weakness may lead to new rounds of layoffs, business failures.

- Corporate loan growth may slow as firms make use of liquidity piles.

- OPEC and allies to ease oil cuts amid demand recovery.

- Canada’s long-term financial profile is consistent with AAA rating.

- Tesla Inc (NASDAQ: TSLA) to hold shareholder meeting, battery day on 9/22.

- Credit Suisse Group AG (NYSE: CS) settles shareholder suit over debt.

- Boeing Co (NYSE: BA) scrambles over 737 MAX financing.

- Amazon.com Inc (NASDAQ: AMZN) rolling out bigger United Parcel Service Inc (NYSE: UPS), FedEx Corporation (NYSE: FDX) style trucks.

- Pfizer Inc (NYSE: PFE), BioNTech SE (NASDAQ: BNTX) vaccine ready by end of year.

- Canada posts record job gains in June as services reopen.

- U.S. producer prices fall while underlying inflation stabilizes.

- Europe challenges Visa Inc (NYSE: V) and Mastercard Inc (NYSE: MA).

- A Citigroup Inc (NYSE: C) poll of 140 fund managers found that 62% expect Biden to win.

- International trade in LNG collapsed, squeezing outlets for U.S. shale.

- IEA raises 2020 oil demand forecast, but warns COVID-19 clouds outlook.

- Increased tax rates may not matter as much with central banks adding liquidity.

- Jefferies economic activity index has been flat-lined for numerous weeks.

- Legislation to move Chicago casino forward a credit positive.

- China’s manufacturing recovered and exports normalized.

- White House aides urge proposals to undermine Hong Kong’s peg to USD.

- Uber Technologies Inc (NYSE: UBER) to acquire Postmates for $2.65B.

- Savings rate, liquidity to fund upside for motor vehicles, housing.

- Coinbase crypto exchange prepares stock market listing.

- Twitter Inc (NYSE: TWTR), Stitch Fix Inc (NASDAQ: SFIX), Wayfair Inc (NYSE: W), and UpWork Inc (NASDAQ: UPWK) have room for upside.

- U.K. COVID-19 measures add fiscal cost, consolidation plan coming.

- Latin American connectivity leading to increased digitalization of work, commerce.

- Decline in unemployment largely the result of classification.

- Coronavirus to weigh on fiscal 2021 tax revenues despite employment bump.

- Pandemic Unemployment Assistance claims have risen.

- Pandemic is outpacing the ability to respond in some states.

- Gold rally backed by fears of future inflation, debt, and negative yield.

- Sentiment: 27.2% Bullish, 30.2 Neutral, 42.7% Bearish as of 7/12/2020.

Product Analysis:

S&P 500 E-mini Futures (ES) | SPDR S&P 500 ETF Trust (NYSE: SPY)

Nasdaq-100 E-mini Futures (NQ) | PowerShares QQQ Trust (NASDAQ: QQQ)

Russell 2000 E-mini Futures (RTY) | iShares Russell 2000 Index (NYSE: IWM)

Gold Futures (GC) | SPDR Gold Trust (NYSE: GLD)

Crude Oil (CL) | United States Oil Fund LP (NYSE: USO) | Invesco DB Oil Fund (NYSE: DBO) | United States 12 Month Oil Fund (NYSE: USL)

Treasury Bonds (ZB) | iShares 20+ Year Treasury Bond (NASDAQ: TLT)

Cover photo by Andrea Piacquadio from Pexels.

© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.