Dash is a leading crypto in digital payments globally with a huge user adoption in Venezuela and growing acceptance on the African continent.

By leveraging the wide mobile penetration and the fairly unstable currencies and economies, Dash is proving to be a well-fitted solution to these opportunities and challenges on the continent.

BitcoinKE had an exclusive question and answer session with the Dash Nigeria lead, Nathaniel Luz, to understand the use case and adoption level of Dash on the African continent.

Who is using Dash in Africa and Why?

If you plan on living solely on crypto, you have to consider merchant adoption. Dash is being used to pay merchants even without them choosing to accept it.

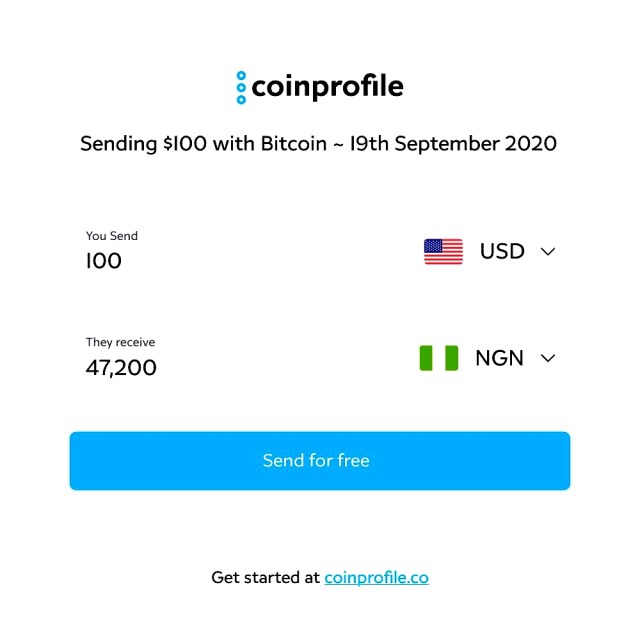

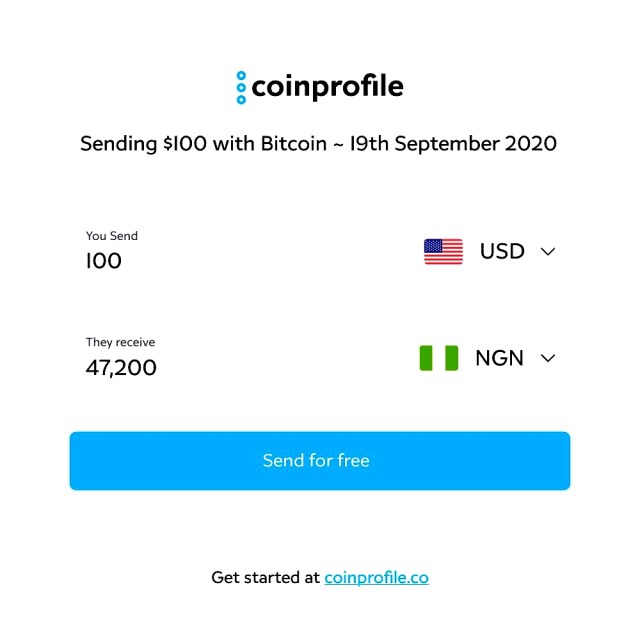

CoinProfile, a Nigerian-based crypto-to-fiat platform lets Nigerians use Dash to pay for goods offered and services rendered. The merchant simply receives payment in the local currency making it possible to completely live off Dash. You can send Dash from anywhere in the world directly to a local bank account on the platform making it very convenient for remittances due to its low or zero fees and in less than two minutes.

AnkerPay, a South-African based ATM and crypto payments services provider, has also added Dash on its platform. This means you can access Dash across its large ATM and POS network allowing merchants to accept Dash on their brick and mortar shops and direct convert it to fiat if they wish.

NaijaCrypto, a Nigerian crypto exchange, has added Dash onto its platform enabling users to directly make Dash withdrawals at any any ATM stand in the local Naira currency via its debit card which can be used anywhere.

Many companies in Nigeria are now using cryptocurrency since the government has put a $20 per month transaction limit on all bank accounts. Can you believe that? An example of such is a domain site I use known as Gigalayer (https://www.gigalayer.com.ng/) and they give me a 30% discount if I use Dash as a mode of payment. The increased instability of the Naira has led to more Nigerians keeping their money in crypto.

There are also plans to integrate Dash Text, a service that lets you send and receive Dash in USSD code, across areas in Africa that have unstable or no internet connection. Think of it as Dash mobile money.

SEE ALSO: First Health Spa in Nairobi to Accept Bitcoin and Dash

What are the volumes being transacted at Dash currently?

Dash was ranked #31 in Coincap with trading volumes of

- Market Cap – Approximately $700 million

- 24 hour volume – approximately $50 million

What makes Dash stand out from other cryptos?

Here are some of the characteristics of Dash that separate it from the rest:

- Security is key at Dash Nigeria. (He gave an example of lack of security in traditional setting where the Nigerian government made peoples’ BVN numbers {similar to Kenya’s huduma number} public with was an outcry and a breach of privacy the government has exposed the owners to all sorts of insecurities one can imagine).

- Dash is fast and takes seconds to transact

- Low fees where $1 in fees goes a long way

What is the approach you at Dash are using to get adopted in Africa?

We have a free Dash book that explains digital currencies in very simple terms.

We also feel that there is not enough being done to educate people about the very basics of digital currencies and why they are needed in the first place. The limited knowledge gained from such learning material is not enough to hasten crypto adoption.

Educating the communities on crypto is thus our biggest and strongest strategy that we are using to promote adoption in Africa. It is working well so far in the West and we hope it will have adoption soon in East and Sothern Africa.

You can now book +2.2M Hotels and Homes in 230 countries using $DASH

Travel to 90,000 destinations worldwide with your favorite #cryptocurrency

Support Crypto Adoption! Book now on https://t.co/CL8FxAXFXS Hotel#Travala $AVA #DASH @Dashpay @StayDashy @DashpayNews pic.twitter.com/MiL5Bn0H09

— Travala.com 🏨 ✈️ 🏡 (@travalacom) September 22, 2020

What is your opinion on regulations across Africa especially the current Nigerian regulation? What would that mean for dash and Africa as a whole?

With the Naira under strain, most Nigerians have simply turned to using Dash and other cryptocurrencies for remittances and international payments. This boom in the use of crypto in Nigeria lately has led to the emergence of new crypto startups as well as raising the eye brows of the regulators. In the classification of SEC Nigeria, Dash falls under the ‘Crypto Asset – non fiat virtual currency’ grouping. This is a welcome development since Dash as a virtual currency does not classify as a commodity or security and the existence of Dash since 2014 pre-dates the ICO days.

The classification is an attempt to re-route crypto activities via the SEC. In that, I think the SEC is late to the game as the space has evolved beyond that. It is noticeable the regulators show some level of recognition for digital assets. However, the statement does not specifically address the legality or illegality of crypto assets.

At Dash Nigeria we are keen and open to working with the regulators should they require any clarifications regarding the classification of Dash.

What is your opinion on crypto in Africa?

There is a lot of work to be done in terms of cryptocurrency growing to where it is supposed to be. Dash Nigeria is working with the regulators in Nigeria to come up with terms and conditions that are favorable to both parties. Dash Nigeria has sent a copy of its book to the regulators and legislators so that they educate themselves and understand what is cryptocurenccy. We are going to follow up soon on progress.

What sort of emerging trends do you believe we’ll see in the blockchain and cryptocurrency space over the next 12-18 months?

The goal will be domination, strategy will be distribution, and the buzzword will be DeFi. Companies/ projects will strive to extend their reach and that will become a relevant metric in the rating and perception. The scramble for Africa will intensify as financial war chests begin to get interested in Africa.

The biggest puzzle to solve will be the joint issues of governance and funding of decentralized projects. Projects that successfully solve this have a higher chance of success.

We’ll see an evolution in real world adoption and use cases, beginning with payments and remittances. Crypto adoption will increase sporadically as the global financial sector witnesses a remarkable financial crises.

Follow us on Twitter for latest posts and updates

Open a Paxful Bitcoin Trading Account today!