Crypto Dock Review

| Broker | Crypto Dock |

|---|---|

| Website URL | https://crypto-dock.com/ |

| Founded | 2021 |

| Support Types | Live Chat, Email, Blog, Twitter |

| Languages | English, |

| Trading Platform | Proprietary |

| Minimum 1st Deposit | 0.0001BTC – $250 |

| Bonus | No KYC Required |

| Leverage | Up to 100:1 |

| Deposit Methods | Bitcoin (BTC), USDT |

| Withdrawal Methods | Bitcoin (BTC), USDT |

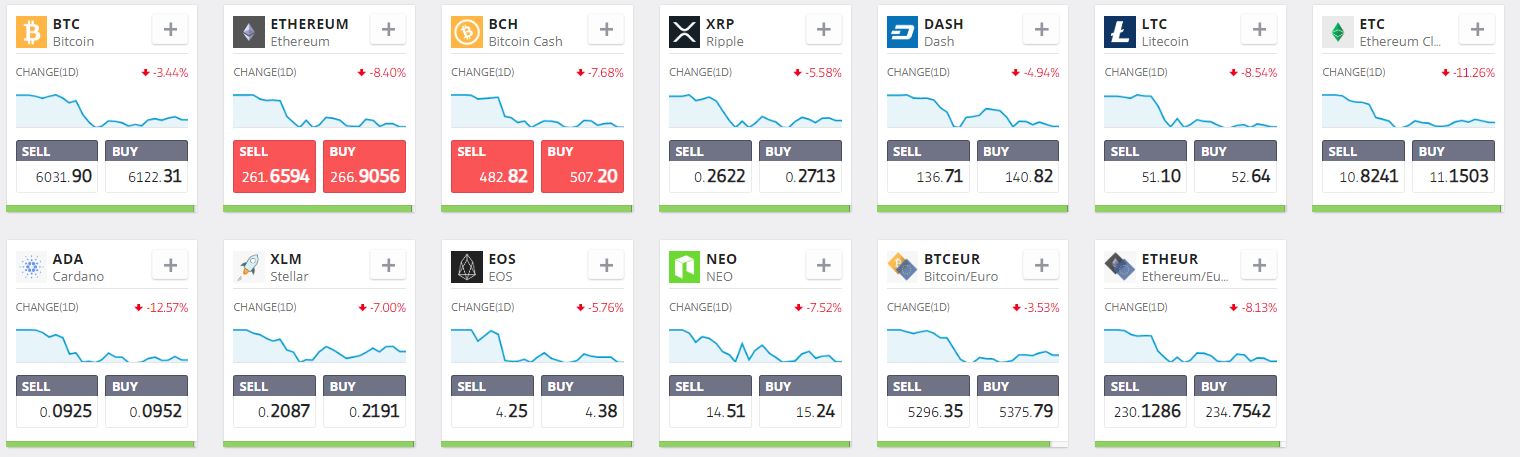

| Number of Assets | 300+ |

| Trading Currency | Crypto, FX Stock, Commodities, Indices |

| US Traders Allowed | NO |

| Mobile Trading | YES |

| Tablet Trading | YES |

Is Crypto Dock a scammy margin trading broker?

Is Crypto Dock a reliable crypto broker where you can trust your bitcoin trading account?

Read this honest Review and learn more information about Crypto Dock, so you can personally decide if this Broker fits to your needs!!

About Crypto Dock (The Company)

Crypto Dock is a margin trading crypto broker, like Celox. The company behind Crypto-Dock is owned and operated by Maximo Ventures Ltd,. Beachmont Business Centre, 143, Kingstown, 1510, Saint Vincent and the Grenadines.

Trading in Crypto Dock is anonymous.

Signing up is easy and fast, just using an email and a password. The is no KYC required, no personal data is shared with the company. Crypto Dock takes anonymity to the next level, offering a no KYC promise:

Trading Instruments, Platform and Charts

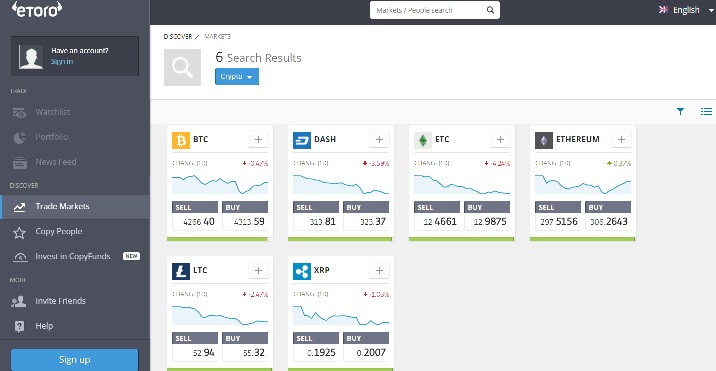

Crypto Dock currently has futures on bitcoin (BTC) and other altcoins: Ethereum (ETH), Ripple (RRP), Bitcoin Cash (BCH), Litecoin (LTC), Binance coin (BNB). In Bitcoin maximum leverage is 100:1, in other instruments is up to 20:1. Crypto Dock claims to have the lowest fees in the market on BTCUSD and BTCUSDT (Bitcoin to Tether).

This is not the case but they are very competitive. they offer multiple other financial

Crypto Dock is using the advanced Charts. Its platform is easy to use even for a newbie and offers real-time information

and market insights in various trading markets. A newbie trader can start using the tools and features provided and learn trading through an amusing process.

An increasing number of traders start to use Crypto Dock every month, sign of the quality work made by the company. Also, most new Crypto Dock clients are newbie traders, proof that Crypto Dock platform is really easy to use.

Sign Up Process, Deposits and Security

As mentioned before, the sign up process is extremely easy.

You just need an email and a password to sign up.

- Visit Crypto Dock webpage and click the ‘Register’ Link. You will find it on the right top of their website.

- Sign up by enter your Email (you can use any email account if you don’t want to use your personal), select a Password (you can keep this password offline if it is hard to remember) and a write a Nickname.

- Verify your account through the link that Crypto Dock sent you in your email. You are done.

After your account is validated you have to deposit a crypto to start trading. In Crypto Dock you can deposit Bitcoins or USDT (USD Tether).

Security

Crypto Dock pays the highest attention to security issues, trying to offer the highest level of protection to its clients.

Crypto Dock has hired a group of elite engineers and professionals of cryptocurrency all over the world.

Crypto Dock has never been hacked since its launch . Crypto Dock has obtained the highest security rating from Mozilla Observatory Test.

Stable server: Crypto Dock has never had a system break down nor has encountered an overload since launch.

Cold storage: All assets on Crypto Dock are stored in multi-signature cold wallets only. All Crypto Dock addresses are multi-signature, and all storage is kept offline. This means, even in the event of a system compromise, an attacker still will not have full access to all the required keys to steal funds.

Withdrawal Security: Every withdrawal is manually audited before sending and requires the coordinated actions of multiple Crypto Dock employees. No private key is kept on any cloud server. All deposit addresses sent by the Crypto Dock system are verified by an external service to ensure that they contain the keys that the founders control. If the public keys do not match, the system is immediately shut down, and trading is stopped.

Conclusion:

Crypto Dock is a new trading exchange aspiring to attract newbie and experienced traders. The company has no complaint history up to day, has a strong security aware and offers safe margin trading with high leverage.

we think that a cryptotrader should not give a trading opportunity to Crypto Dock by signing a Real Crypto Trading Account and start trading in Crypto Dock.

Pros

- Funds are held in Cold Storage

- Advanced Chart Tools

- Fair and Competitive trading fees

- Stable server with no breakdowns

- High Leverage

Cons

- Not enough operating history

- No MT5 – MT4 Broker

- Unregulated Broker

- no real transparency