Tuesday, September 22, 2020 / 02:00PM /

Aelex Partners / Header Image Credit: Aelex Partners

Introduction

This

is the second part to the article on Regulating Cryptocurrency and Initial

Offerings: The Nigerian Perspective, (read part one here).

In part two, we explore Initial Coin Offerings (ICOs), how it is used to raise

funds, the Nigerian legal framework on ICOs, and the pros and cons of ICOs.

A New Way of

Raising Capital

The

rapid increase in the value of cryptocurrency and the possibility of high gains

within a short time frame has seen a number of companies deciding to use the

technology driving cryptocurrency to raise funds.

Companies

have started seriously considering ICOs as a viable tool to raise capital as opposed

to Initial Public Offerings (“IPOs”). This is because ICOs are not subject to

as much regulatory oversight as IPOs considering the definition of tokens fall

outside the scope of regulated investment instruments in most jurisdictions,

thus simplifying the offering process. In addition, companies get to protect

their shareholding against dilution as the assets on offer during are ICO are

tokens and not shares in the company.

In

2017, it was posited by financial experts that there was an ICO Bubble1, (a situation where the price of coins

far exceeded their fundamental value due to their connection to ICOs) This was

supported by the fact that in 2017 alone, USD1,362,588,431 was raised from the

top ten ICOs2 globally.

Though the bubble may have burst in 2019 due to ICOs not being able to meet

their targets and the prevalence of fraudulent ICOs, they are still being used

by companies to raise capital3

and the promise of rapid, large investment returns makes it more appealing to

investors.

IPO vs ICO

There

is still a debate in the financial industry that tokens constitute a share or

security of the company; therefore it is similar to an IPO because ownership is

being sold through the use of the tokens instead of shares. This assertion has

its flaws because fundamental differences exist between an IPO and an ICO which

will be highlighted below.

IPO | ICO |

The company sells part of | The company has a unique |

The capital gained is used | The tokens are usually sold |

The owners of the shares | The owners of a token gain |

IPOs are heavily regulated

| ICOs are hardly regulated |

An IPO involves a lot of | An ICO does not involve |

The

characteristics of an ICO and the freedom it affords companies looking to raise

capital has aided the increasing popularity of token sales and in recent times,

ICOs have been categorized and broken down for potential investors to

understand the intricacies of the process.

The Token Sale

An

ICO or a Token Sale is the process of raising capital through the sale of

tokens to the public for a limited period in exchange for cryptocurrency5. Instead of receiving shares like a

typical IPO, investors receive tokens and pay in cryptocurrency (or cash in

some instances). The tokens received represent the participation of the

investors in the project the ICO was created to raise capital for.

So, Investors in a Token Sale are usually

called participants because ICOs are a form of Crowdfunding; however the

company will be receiving cryptocurrency rather than cash.6 This can be compared to equity-based

crowdfunding where the public donates cash in exchange for shares in the

company7.

Types of Token Sales

There

are two major types of ICOs the Private ICO and the Public ICO. In a Private

ICO, a limited number of investors, typically financial institutions and high

net-worth individuals, participate in the process. The company can choose to

set a minimum investment amount8.

A

Public ICO on the other hand, is open to the general public, with no limits on

who may participate, subject to any regulatory considerations in the relevant

jurisdiction9.

However,

Private ICOs are becoming a more preferred option compared to public offerings as

regulators are now looking at ways to regulate Public ICOs in order to protect

the investing public.

Characteristics of a Token Sale

In

order to mitigate the risk investors associate with ICOs, companies have had to

be strategic in structuring ICOs and four characteristics have emerged as the

foundation for any Token Sale Model.

- A cap on the amount of

money that will be raised from the ICO; - An appropriate time frame

for the period the ICO will run in order to gain the attention of buyers.

The time frame must not be too long so investors can see actual results

and for the specified project to move to the next phase; - Public information on the

number of tokens that are in circulation, the amount that is going to be

sold and the amount currently being held by all stakeholders in the

ecosystem of the token; and - The value of the token

must be clear and unambiguous10.

The

structure of an ICO and the benefits a token offers determines the type of

investors it attracts. The utility the token offers is also one of the factors

that will determine whether an investor will use the token he acquired or trade

it off in return for another token with a different utility or cash.

The Types of Investors in a Token Sale

There

are two types of participants in a Token Sale – Stakeholders and Speculators.

Stakeholders are buyers who acquire a token to be able to use it for the true

utility it was created for. In the first article, we talked about the Brave

browser and how it is using its Basic Attention Token (BAT) to create value by

rewarding people who advertise on its browser with the token when a user views

their ad which does not have an ad tracker or is transparent11. If the Brave browser was to have an

ICO, they would most likely sell their BAT and a Stakeholder buyer would

acquire it to use in securing an advert space on the browser because the BAT

can be used in the Brave ecosystem to gain products or services12.

Speculators

are investors who do not wish to use the utility that a token offers. They

participated in the Token Sale with the hope of making a return on the token

when its value rises, either by selling to Stakeholders or other Speculators.

ICOs

require an understanding of a combination of finance, technology and the

regulatory requirements that may hinder the process in the jurisdiction the

issuing entity resides in. Therefore, the steps highlighted below in order to

be successful will entail an understanding of the subject matter

aforementioned.

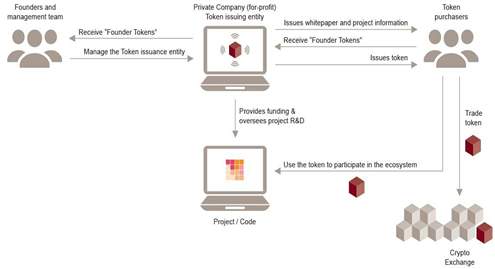

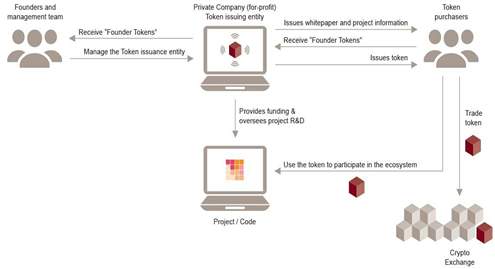

Kickstarting a Token Sale

Because

the mechanism for an ICO is fairly simple, it has a low barrier of entry and in

most jurisdictions, it can be started without jumping through regulatory hoops.

There are typically four stages in kickstarting an ICO:

Stage

One:

This

includes the preliminary stage where the company or the token issuing entity

identifies their potential investors and the project they want to fund.

After

identifying its potential investors and its underlying project, the token

issuing entity will issue a White Paper (similar to a Prospectus for an IPO)

that provides details of the underlying project and details of the tokens that

will be issued in exchange for cryptocurrency13.

The

White Paper is made publicly available, usually through the issuing entity’s

website. The White Paper will include the mechanism for payment of

cryptocurrency to the issuing entity’s account. t is now common practice for

payments to be made into an escrow account, to foster investor confidence in

the validity of the ICO14.

Stage

Two:

The

tokens are created. The tokens will be the representations of an asset or a

utility on the blockchain native to the token and are tradeable for other

tokens or coins15. The

issuing entity does not need to create new tokens, instead they can build on

existing blockchains such as Ethereum which allows the creation of tokens on

its blockchain.

Stage

Three:

The

issuing entity will usually run a promotion campaign to attract potential

investors. These campaigns are usually executed online to achieve the widest

investor reach. It should be noted that a lot of online platforms such as

Facebook and Google ban the advertising of ICOs16;

therefore, it is recommended that the campaign run on the issuing entities

website or on cryptocurrency exchanges.

Stage

Four:

After

the creation of the tokens, the tokens are issued and the token purchasers or

investors will pay for the tokens, usually in cryptocurrency. Issuing entities

can request for fiat currency if they wish, but common practice is the use of

coins to buy tokens.

Once

the purchasers have paid for the token, they can use their tokens in the

project ecosystem as a utility for the product or trade the token on a

Cryptocurrency exchange, subject to any lock-in period prohibiting the exchange

or sale of the token -this will be stated in the White Paper.

Cryptocurrency

is financially risky as we highlighted in our first article, so in order to

assuage the fears of investors, the management team of the issuing entity

usually take tokens themselves to prove to potential investors that the ICO is

relatively safe.

Below

is a process flowchart highlighting the stages of a typical ICO:

17PWC, Switzerland

The Nigerian Legal Framework on ICOs

As

defined in our first article, a token is an asset built on top of an existing

blockchain, which has the ability to replicate such functionality or assets18. We also explained how securities are

financial assets and provided the definition of securities according to the

Nigerian Regulatory Framework for securities19.

The

regulatory framework for securities being offered to the public or to private

individuals in exchange for cash comprises of the following rules and

regulations:

- The

Investment and Securities Act 2007 (“ISA”); and - The

Rules and Regulations of the Security and Exchange Commission 2013 (“SEC

Rules”).

Article

279(1)(c) of the SEC Rules provide that all securities subject to registration

by the Securities and Exchange Commission (“SEC”) may be offered through the

following methods:

- offer for subscription;

- offer for sale;

- rights issue;

- bonus issue;

- debt-equity conversion;

- private placement by public companies and other entities; and

- offer by introduction;

- debenture/loan stock;

- State and Local government bonds

- Sukuk

The

SEC Rules also provide that an entity may offer or transfer its securities

electronically: provided that where an investor elects to have a certificate,

such certificate shall be issued by the issuer20.

The

aforementioned principles of the SEC Rules seem to give a legal foundation for

potential ICOs in Nigeria but sadly, coins and tokens do not fall under the

scope of securities set out in the ISA and therefore, cannot be registered as

securities that can be offered to the public or to private entities in exchange

for capital in Nigeria. Also, the SEC is yet to classify what coins or tokens

are in Nigeria, hence, ICOs are unregulated in Nigeria.

This

position may soon change as the Proposed Rules on Crowdfunding by SEC21 seem to permit equity crowdfunding

and ICOs are an offshoot of it. The proposed rules provide that an entity may

issue other investment instruments approved by the Commission (including simple

contracts) without registering the securities or investment instruments with

the SEC. Tokens being offered in ICOs are investment contracts that are built

on blockchains and are easily programmable to provide any type of utility the

issuing entity programmes the smart contract to perform. This position has not

been affirmed by the SEC but it is hoped that ICOs can take advantage of the

proposed provisions of the Proposed Rules.

Also,

the National Blockchain Strategy released by the Federal Ministry of

Communications and Digital Economy, while admitting that there is no regulatory

or legal framework for cryptocurrency in Nigeria, believes that there is a

promising future for blockchain in Nigeria due to the adoption of blockchain by

various Nigerian start-ups for numerous purposes. The Blockchain Strategy lists

out the various regulations that the Federal Government has released to create

an enabling environment for cryptocurrency in Nigeria22. It goes further to explain how the Federal

Government wants to use cryptocurrency and blockchain technology as one of the

paths towards a digital economy and one of the strategic objectives is the

creation of investment opportunities through blockchain.

According

to the Blockchain Strategy, “Blockchain

has the potential to completely transform traditional models in several sectors

both private and public. By promoting blockchain adoption and providing an

enabling environment, new business models will spring up to open opportunities

for businesses that will drive investments in a market such as Nigeria.”

This

seems to be a nod to ICOs and the government’s consideration of it to diversify

the Nigerian Economy and the methods of investment in Nigeria.

Furthermore,

the Final Report of the Fintech Roadmap Committee of the Nigerian Capital

Market by the SEC, lists out recommendations that the Capital Market Community

will take into consideration regarding ICOs:

- SEC should be responsible for the regulation of Virtual Financial

Assets (VFAs) Exchanges and develop a framework around it. - For the regulation of crowdfunding, interest-based crowdfunding

should be regulated by the Central Bank of Nigeria (CBN) while equity-based

crowdfunding should be regulated by the SEC (ICO, STO or IPOs). - SEC should issue guidelines and standards for White Papers and

ICOs. - Advertising and issuance procedures should be defined without

ambiguity. - SEC should create appropriate licensing regimes for new entrants

into the crowdfunding ecosystem. - SEC should develop a detailed framework for VFA based economy.

- SEC should develop a stringent framework for KYC and due diligence

which will apply regardless of the legal status of an ICO or token. - SEC should have clear taxonomies of tokens based on their nature,

characteristics and economic realities as their determining factors. - The taxonomy of traditional securities should remain intact, and

serve as useful, instructive and illustrative guide for the taxonomization of

the new cryptocurrency capital market investment products and services. - The global best practices in order to give a taxonomy to

cryptocurrency assets especially jurisdictions like Malta should be followed by

SEC. The Malta Guide broadly taxonomises tokens as;

- Payment token

- Asset token

- Utility token

ICOs – Risky Business or Not?

Though

the advantages of an ICO were mentioned earlier in this article, they need to

be highlighted again to understand why ICOs are being strongly considered by

companies as a way to raise capital.

Lack of Regulatory Oversight: Most ICOs lack regulatory

oversight, hence it is an interesting opportunity for founders or entities to

adopt it as a method to raise capital. Bypassing the regulatory oversight that

comes with IPOs is a major boost to the appeal of ICOs to issuing entities and

even investors.

Substantial Gain Quickly: Since ICOs have a target and

an estimated time to achieve the target which is usually short23, investors usually gather their funds

to invest heavily in ICOs due to the potential returns that are projected. Most

times the returns projected is higher than returns on fixed or floating assets

such as bonds or shares respectively. The recent furore for and discussion

around the novelty and profitability of ICOs has whetted the risk appetite of

certain investors hoping to make a huge return on their investments, which

means that the issuing entity also sees a quick inflow of capital.

Anyone can Invest: Due to the nature and

accessibility of ICOs which are typically offered online, issuing entities are

not limited to investors within their geographical area, and do not incur costs

that are typically seen with the traditional methods of raising capital. Anyone

can invest in an ICO and the pool of potential investors is essentially every

user of the World Wide Web. The use of cryptocurrency also means that the

issuing entity does not need to worry with the currency in which to dominate

the offer and thus, bypasses any foreign exchange concerns.

So,

with all the advantages mentioned above, why are ICOs still considered risky

business? Well in 2017 alone, 80% of ICOs were identified as scams by Statis

group, an ICO advisory firm24.

To put in context, US$11.9 billion of investor money fell to scams in 2017 and

three fake ICOs alone consumed US$1.31 billion25.

Also,

the lack of regulatory oversight means most ICOs end up “going dead”26 and investors cannot recoup their money

due to the lack of a mechanism or a reporting procedure to reclaim their funds.

In

addition, investors and issuing entities are faced with the risk of digital

currency theft as cryptocurrency wallets – where the coins or tokens stored –

are hackable. A study27 from

CipherTrace, a cryptocurrency intelligence firm based in Silicon Valley

provided an overview of the major cryptocurrency thefts, scams, and fraud

worldwide in 2019. The study showed that criminals and fraudsters netted

approximately US$4.26 billion for the first six months of 2019 and US$1.7

billion for the entire 2018 according to the study.

Although

exchanges, wallets, and other cryptocurrency custody services are strengthening

their defenses, hackers continue to innovate and outpace even the current state

of the art in cybersecurity, the CipherTrace study notes28.

Conclusion

ICOs

are not popular in Nigeria and are hardly used to raise capital by entities in

this part of the world. Also, given the fact that coins and tokens are not

classified in Nigeria, the absence of classification makes Nigeria a very harsh

terrain for an ICO to be conducted, but that may soon change.

In

January 2018, SureRemit a Nigerian non-cash remittance start-up raised $7

million through an ICO29.

ICOs may become the rave for Nigerian tech companies who do not want to jump

through the regulatory loopholes of the SEC for raising capital and registering

securities.

The

drive of the Federal Government and SEC is also duly noted as the government

and its apex capital market regulatory body looks into the future to tap the

benefits of cryptocurrency and all the technology that comes with its use.

This article is part

of the series titled THE CHANGING OF FINANCE IN NIGERIA highlighting the

various modern financial developments in Nigeria. Other articles in the series

may be accessed here.

Footnotes

1. The

Financial Times, “ICO regulation inconsistent as cryptocurrency bubble fears

grow” https://www.ft.com/content/32315636-cb01-11e7-ab18-7a9fb7d6163e

accessed 5 August 2020.

2.

PWC, “Introduction to Token Sales (ICO) Best Practices” https://www.pwccn.com/en/financial-services/publications/introduction-to-token-sales-ico-best-practices.pdf accessed 5 August 2020.

3.

There

are still ICOs occurring according to various ICO Calendars such as ICODROPS. https://icodrops.com/

4. Deloitte, “Initial Coin Offering a new Paradigm” https://www2.deloitte.com/ru/en/pages/financial-services/articles/initial-coin-offering-a-new-paradigm.html.

accessed 6 August 2020

5.

PWC, “Introduction to Token Sales (ICO) Best Practices” https://www.pwccn.com/en/financial-services/publications/introduction-to-token-sales-ico-best-practices.pdf accessed 5 August 2020.

6. ACCA, “ICOs: real deal or token gesture? Exploring Initial Coin Offerings” https://www.accaglobal.com/content/dam/ACCA_Global/professional-insights/Initial-coin-offerings/pi-initial-coin-offerings.pdf accessed 6 August 2020.

7. Oyeyosola

Diya, “The Changing Face of Finance in Nigeria : Crowdfunding” https://www.aelex.com/wp-content/uploads/2020/03/THE-CHANGING-FACE-OF-FINANCE-IN-NIGERIA-CROWDFUNDING1.pdf accessed 6 August 2020.

8.

Corporate

Finance Institute, “Initial Coin Offering (ICO) An initial public offering that

uses cryptocurrencies” https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/initial-coin-offering-ico/ accessed 6 August 2020.

9.

Corporate

Finance Institute, “Initial Coin Offering (ICO) An initial public offering that

uses cryptocurrencies”

https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/initial-coin-offering-ico/ accessed 6 August 2020.

10.Deloitte, “Initial Coin Offering a new Paradigm” https://www2.deloitte.com/ru/en/pages/financial-services/articles/initial-coin-offering-a-new-paradigm.html accessed 6 August 2020

11.

Oluwapelumi

C. Omoniyi, ” Regulating Cryptocurrency and Initial Coin Offerings: the

Nigerian Perspective” https://www.aelex.com/regulating-cryptocurrency-and-initial-coin-offerings-the-nigerian-perspective/ accessed 6 August 2020.

12.Deloitte, “Initial Coin Offering a new Paradigm” https://www2.deloitte.com/ru/en/pages/financial-services/articles/initial-coin-offering-a-new-paradigm.html

accessed 6 August 2020

13.ACCA, “ICOs: real deal or token gesture? Exploring Initial Coin Offerings” https://www.accaglobal.com/content/dam/ACCA_Global/professional-insights/Initial-coin-offerings/pi-initial-coin-offerings.pdf accessed 6 August 2020.

14.ACCA, “ICOs: real deal or token gesture? Exploring Initial Coin Offerings” https://www.accaglobal.com/content/dam/ACCA_Global/professional-insights/Initial-coin-offerings/pi-initial-coin-offerings.pdf accessed 6 August 2020.

15. Corporate

Finance Institute, “Initial Coin Offering (ICO) An initial public offering that

uses cryptocurrencies” https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/initial-coin-offering-ico/ accessed 6 August 2020.

16.

Corporate

Finance Institute, “Initial Coin Offering (ICO) An initial public offering that

uses cryptocurrencies” https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/initial-coin-offering-ico/ accessed 17 August 2020.

17. PWC, “ICO Regulation & Compliance Legal Frameworks and regulation for ICOs” https://www.pwc.ch/en/industry-sectors/financial-services/fs-regulations/ico.html accessed 6 August 2020.

18.

Oluwapelumi

C. Omoniyi, “regulating Cryptocurrency and Initial Coin Offerings : the

Nigerian Perspective” https://www.aelex.com/regulating-cryptocurrency-and-initial-coin-offerings-the-nigerian-perspective/ accessed 6 August 2020

19.

The

Investment and Securities Act 2007 in Section 315 defines ‘security’ to mean:

debentures, stocks or bonds issued or

proposed to be issued by a government;

debentures, stocks, shares, bonds or notes

issued or proposed to be issued by a body corporate;

right or option in respect of any such

debentures, stocks, shares, bonds or notes; or

commodities futures, contracts, options and

other derivatives,

The definition

of securities in the ISA included those securities which may be transferred by

means of any electronic mode approved by the Securities and Exchange Commission

(SEC) and which may be deposited, kept or stored with any licensed depository

or custodian company as provided under the ISA

20.

Article

345 of the Rules and Regulations of the Security and Exchange Commission 2013

(SEC Rules).

21.

SEC

Nigeria, “Exposure of Proposed new Rules to the Rules and Regulations of the

Commission” https://sec.gov.ng/wp-content/uploads/2020/03/SEC-NG-Crowdfunding-Rules-for-Exposure-March-2020.pdf

accessed 9 August 2020.

22.

National

Digital Economy Strategy and Policy 2020-2030, National IT Policy 2012,

E-Government Master Plan, Nigeria Cloud Policy 2019, National Broadband Plan 2020-2025 and the Nigeria Data

Protection Regulation 2019

23.

The

longer the ICO period, the less appealing it looks to investors.

24.

“Sherwin Dowlat, “Cryptoasset Market Coverage Initiation: Network Creation July

11, 2018” https://research.bloomberg.com/pub/res/d28giW28tf6G7T_Wr77aU0gDgFQ accessed

10 August 2020.

Ana Alexandre, “New Study Says 80 Percent

of ICOs Conducted in 2017 Were Scams”

https://cointelegraph.com/news/new-study-says-80-percent-of-icos-conducted-in-2017-were-scams accessed 10 August 2020.

25.

Pincoin

($660 million), Arisebank ($600 million), and Savedroid ($50 million).

26.

TechCrunch released a

report based on data from Coinopsy and DeadCoins, which found that more than a

thousand crypto projects were “already dead” as of June 30, 2018.

Helen Partz,

“Over 1000 Crypto Projects Are Considered ‘Dead’ Now”https://cointelegraph.com/news/techcrunch-over-1000-crypto-projects-are-considered-dead-now accessed 10 August 2020.

27.Cipher

Trace, “Q2 2019

Cryptocurrency Anti-Money Laundering Report” https://ciphertrace.com/q2-2019-cryptocurrency-anti-money-laundering-report/ accessed 10 August 2020.

Jeb Su,

“Hackers Stole Over $4 Billion From Crypto Crimes In 2019 So Far, Up From $1.7

Billion In All Of 2018” https://www.forbes.com/sites/jeanbaptiste/2019/08/15/hackers-stole-over-4-billion-from-crypto-crimes-in-2019-so-far-up-from-1-7-billion-in-all-of-2018/#229fc9a655f5 accessed 10 August 2020.

28.Cipher

Trace, “Q2 2019 Cryptocurrency Anti-Money

Laundering Report” https://ciphertrace.com/q2-2019-cryptocurrency-anti-money-laundering-report/ accessed 10 August 2020.

Jeb Su,

“Hackers Stole Over $4 Billion From Crypto Crimes In 2019 So Far, Up From $1.7

Billion In All Of 2018” https://www.forbes.com/sites/jeanbaptiste/2019/08/15/hackers-stole-over-4-billion-from-crypto-crimes-in-2019-so-far-up-from-1-7-billion-in-all-of-2018/#229fc9a655f5 accessed 10 August 2020

29. Victor Ekwealor, “3 things you need to know

about ICOs in the Nigerian context” https://techpoint.africa/2018/02/14/ico-nigeria/ accessed 10 August 2020.

Previous Posts from Aelex

1. Regulating

Cryptocurrency and Initial Coin Offerings: The Nigerian Perspective – Part 1 – September 15, 2020

2. Works

Forming Part of the State of the Art are Ineligible for Protection – A Case

Study – September 15, 2020

3. Innovations

Covered Under the Value Added Services (VAS) Licence Framework In Nigeria – September 13, 2020

4. Fraudulent

E-transactions Involving Credit and Debit Cards: Who is Liable? – A Case Study August 31,

2020

5. Powers of

the Courts to Interfere with the Exercise of CAC’s Discretionary Powers – A

Case Study August 27, 2020

6. Casual Work

in Nigeria: The Shortcomings of the Current Legal Framework July 26, 2020

7. Zooming In:

Voice Over Internet Protocol and the Corollary Regulatory Regime in Nigeria – July

19, 2020

8. Finance Act,

2019: Tax Implications for the Private Equity Industry – July 13, 2020

9. Data Backup

and Security Guideline as Impact Mitigation Strategies in Light of the COVID-19

Pandemic – July 15, 2020

Related News

1.

BLOCKDeFi Virtual Conference and Exhibition 2020

2.

China Starts Major Trial of State-Run Digital Currency

3.

IOSCO Report Examines How Existing Regulatory Principles Could

Apply to Stablecoins

4.

BIS: Central Bank Group To Assess Potential Cases For Central

Bank Digital Currencies

5.

Demystifying Cryptocurrency – A Meristem Report

6.

Facebook’s Libra Must Meet Strict Standards – Bank of England

7.

From Stablecoins to Central Bank Digital Currencies

8.

Digital Currencies: The Rise of Stablecoins

9.

Money And Private Currencies: Reflections On Libra

10. UN Details How N.Korea Carried Out Crypto and SWIFT Hacks To

Amass $2bn To Fund Its Nuclear Programs

11.

Do Young Nigerians Prefer Cryptocurrency for Payment?

12. Blockchain Offers Efficiency but Untested in Securitization

13. UK Financial Conduct Authority Proposes Ban On Sale Of

Crypto-Derivatives To Retail Consumers

14. Facebook’s Libra Blockchain May Be Viable Tech Cryptocurrency