This week was quite eventful for crypto and traditional markets, and investors will note that as central banks introduce new monetary expansion policy, Bitcoin (BTC) and altcoins have begun to forge their own path.

Before reading the rundown, catch up on the most-read stories centered around the price of Bitcoin, the macroeconomic picture and the DeFi phenomenon gaining traction.

A seminal moment for Bitcoin and digital assets

Central bank policies first crafted in the wake of the Great Recession, which were then seen as extraordinary, have become ordinary — and concerns are creeping in from all corners of the globe.

Quantitative easing, low interest rates for prolonged periods, stimulus payments and other actions have increasingly been used to prop up the economy, jobs and financial markets ailing from government responses to the COVID-19 pandemic.

This has caused the United States Federal Reserve and Treasury Department to once again rewrite fiscal policy rules to keep the country from sinking under the weight of what seemed to be almost certain financial collapse.

The scope of these efforts is a sharp turn from previous measures such as TARP that focused largely on the financial industry — and they’ve led us to a seminal moment for Bitcoin and other digital assets.

Economists go brrrrrrr

That chill you feel isn’t the end of summer; it’s a collective shiver after remarks made this week by Fed officials in Jackson Hole.

Federal Reserve Chairman Jerome Powell acknowledged the Fed’s new approach this week, explaining that the onus is on bolstering the U.S. labor market with fewer worries about an uptick in inflation.

Tellingly, while Powell acknowledged that past declines in unemployment led to concerns about rising inflation and prompted the Fed to raise interest rates, the central bank will no longer take such actions.

This is a potentially frightening prospect for anyone interested in the value of money and has seen the disastrous effects of an unrestrained expansion of the money supply in countries such as Venezuela, Russia, Brazil and elsewhere.

The reason why it matters for digital assets is two-fold: technology and anti-inflation potential — an ability to tap into unbanked communities and spread the “credit and confidence.”

In terms of market reaction, longer-term U.S. Treasury yields climbed to their highest levels in months on Thursday, steepening the yield curve, after Powell announced this new policy framework promoting higher inflation to spur economic recovery and job creation.

Cryptocurrency market weekly performance snapshot. Source: Coin360

Going forward, it is worth keeping an eye on the broader commodities complex and also how expectations develop. Correlations that may apply now may no longer be true, especially those related to inflation.

Not surprisingly, Bitcoin (BTC) and gold traded in lock-step for much of the session, initially spiking higher before reversing and falling to new session lows.

They might be onto something

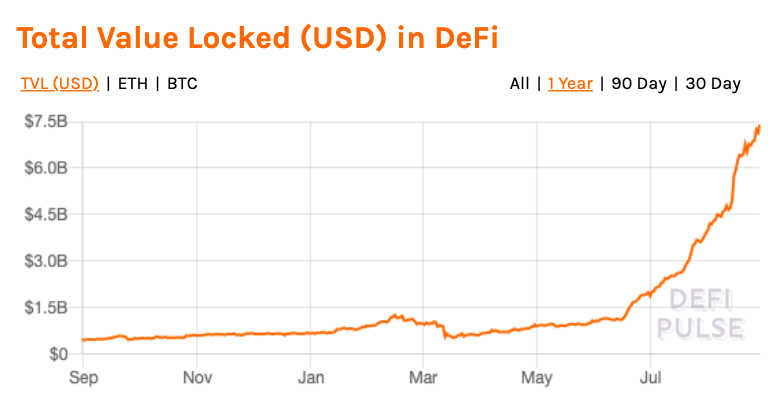

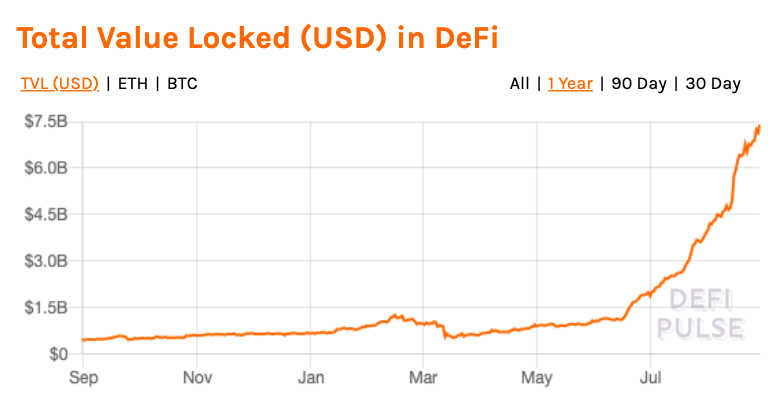

Another week brought another wave of capital inflows to DeFi projects. The total amount locked is now at $7.22 billion, and the top three assets — which include the likes of Aave, Maker and Curve — have over $1 billion locked each.

Total value locked in DeFi (USD). Source: Defi Pulse

The total number of Bitcoin locked in the ecosystem has now risen to 46,086, with Wrapped Bitcoin (wBTC) accounting for 30,798, followed by renBTC with 8,408. Surprisingly, even though transaction costs on the Ethereum network have fallen from recent highs, it failed to translate into a meaningful rise in trading volumes on decentralized exchanges.

This suggests that the market likely pressured out smaller participants and is now dominated by larger funds and token holders.

As such, future growth is more of a byproduct of innovation and further development of the underlying infrastructure — capital flows do not seem to be an issue, as evidenced by ongoing growth across just about every known DeFi platform.

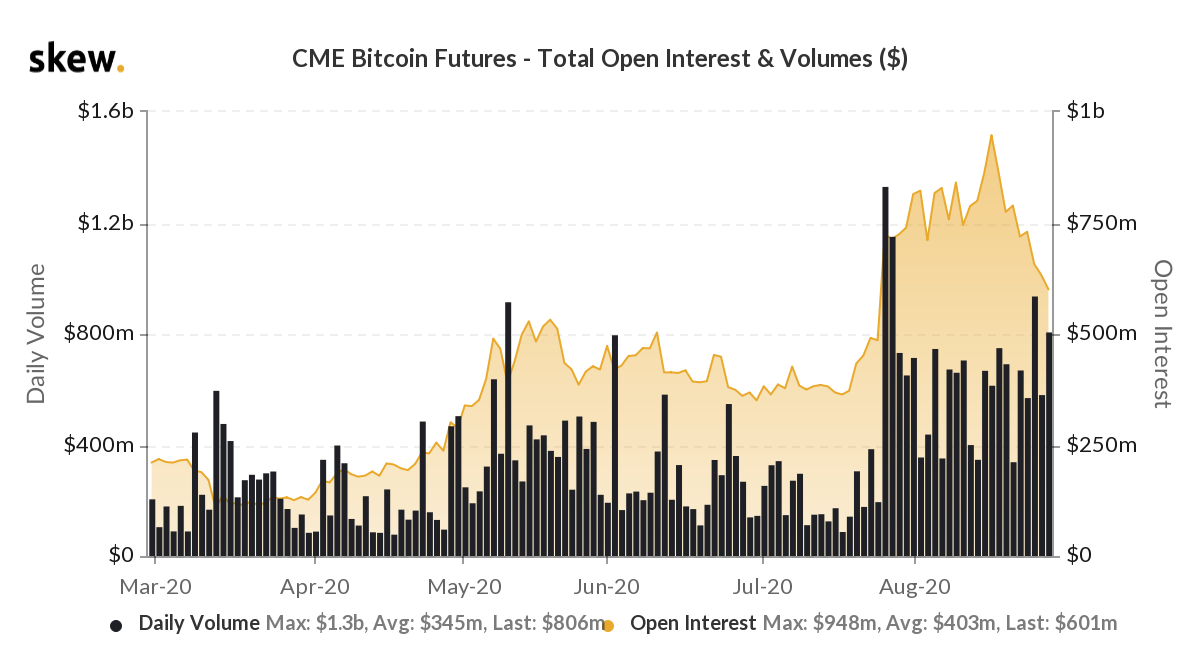

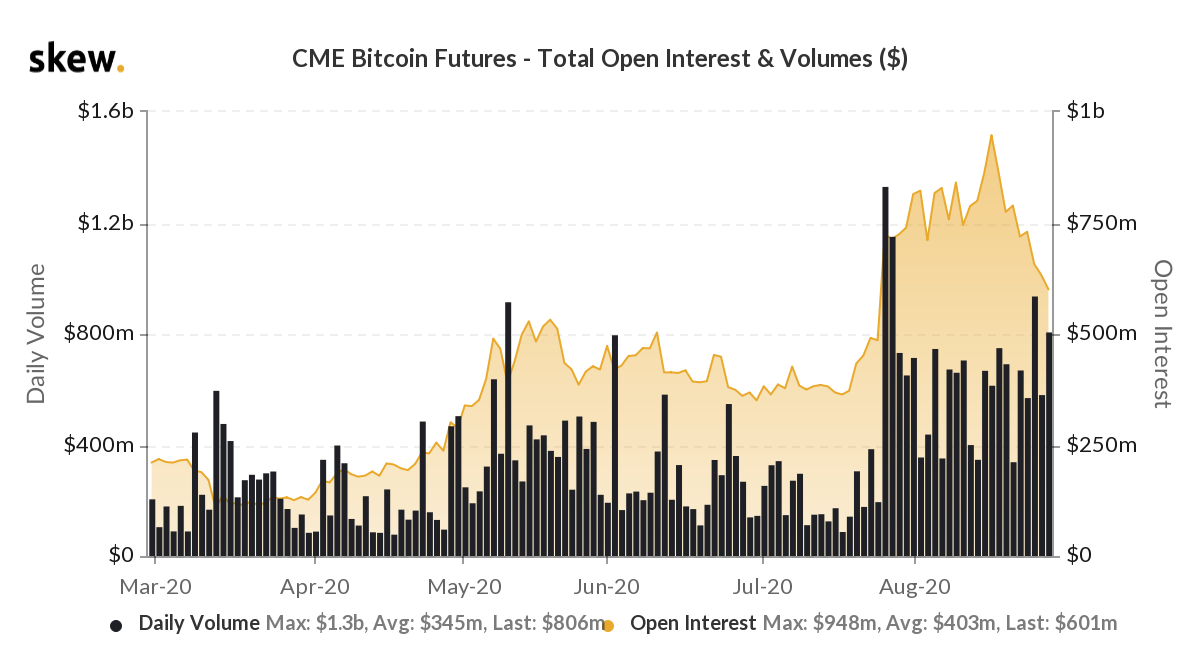

According to the latest post by the CME Group, the number of unique accounts that have traded Bitcoin futures since launch exceeds 5,400. As new participants enter the market, the number of large open interest holders (LOIHs) continues to grow. And on that note, a record number of 94 holders was established the week of Aug. 18.

CME BTC futures open interest and volume. Source: Skew

Furthermore, the number of LOIHs has risen sharply since Q4 2019, which indicates growing institutional interest because an LOIH is a holder of at least 25 contracts. A record number of 94 holders was established the week of Aug. 18.

In addition to that, along with the rise in LOIHs, average daily open interest has been steadily increasing since March and for the last four months has exceeded average daily volume (ADV).

Open Interest reached a record of 15,406 contracts (77,030 equivalent Bitcoin) on Aug. 17 and is averaging 13,672 contracts for the month, a 40% increase from July. ADV in August is 9,570 contracts (47,850 equivalent Bitcoin), up roughly 30% from July.