Our goal at Insider Opportunities is reaching outperforming returns while reducing downside risks. Bitcoin (BTC-USD) has never gotten a place in this strategy given its high volatility, hard predictability and our scrutiny regarding hypes.

However, 2020 has been an unprecedented year which asks for unprecedented actions. Given the zero interest rate environment, historically high S&P 500 (SPY) valuations and Fed stimuli, Bitcoin is getting much more attractive. Meanwhile, the narrative around Bitcoin is changing from a speculative asset to a risk-reducing asset (similar to gold) as short-term investors are switching to highly volatile stocks like AMD (AMD), Shopify (SHOP), Nikola (NKLA) and Tesla (TSLA).

Recently, a new bullish Bitcoin trend awoke, and given the abnormal market environment, I decided to have a closer look at it.

First, this article will quickly discuss what Bitcoin really stands for. Later, I will provide three reasons why Bitcoin might be an interesting asset to purchase, even for risk-minded investors who focus on stocks. To finish, I will discuss the most interesting way to play this starting Bitcoin rally.

Introduction to Bitcoin

Bitcoin is a fixed supply digital asset that was meant to be used as a decentralized system supporting peer-to-peer anonymous transactions. Because of the decentralized nature of the asset, instead of relying on third parties, Bitcoin users only need to trust the code that makes up the asset and underlying platform. I purposefully made a distinction between platform and asset in this technology because the original founder of this asset (known only by the name Satoshi Nakamoto)had to invent a new way of digitally storing data in a decentralised, intangible and secure manner. To accomplish that, he created a giant decentralized ledger, called “the Bitcoin blockchain,” to record every Bitcoin address together with its value, in and out transactions, and much more.

As stated in the original white paper, Bitcoin was meant to be a payment method and solution to a major global issue – the lack of trust in fiat systems. To trust a fiat system like paper money and the value thereof, you have to trust the people or institutions behind it (governments and central banks). To trust Bitcoin, you’ll have to trust the underlying code and blockchain architecture. This means that the trust can be moved away from a central person, group or institution and moved toward code that’s open source and fixed in nature. The code is written by Bitcoin developers and voted upon by Bitcoin miners. Changes to the main code branch can only be stored into the blockchain if editors and >95% of the mining power agrees with them. It’s always up to the Bitcoin community which Bitcoin version they want to use and support, therefore there isn’t one entity that has the power to enforce any Bitcoin version.

Miners are entities in the form of computational power that keep the Bitcoin network (underlying blockchain) in check, ensuring its integrity and updating its records continuously. In essence, every minor or major change (ranging from a single transaction to a software improvement) that needs to be applied onto the blockchain will be sorted in a queue. Miners will then check the validity of the transactions. As soon as 50% of the total mining power agrees to accept a give transaction into the network, they will be stored accepted on the next block and recorded into the block chain.

(Source: PwC)

In contrast to the popular belief, Bitcoin has now proven to be secure for over a decade without exceptions. There hasn’t been a single high-risk security issue recorded throughout Bitcoin’s history, while it’s in fact the most heavily used and most valuable digital asset. One must expect that many hackers have tried and failed to hack into the Bitcoin network. In fact, because of the nature of how changes are accepted into the blockchain, the only way to force false changes is to effectively own more than 50% of the mining power at any give time. This principle is called a 51% attack, and it’s the reason why it would be to expensive for a hacker today to attack the Bitcoin network. Banks are much more prone to attacks and have a far worse record of successful digital and/or physical attacks compared to the Bitcoin network.

Why Bitcoin currently is an interesting asset class

1. Bitcoin as safe haven for portfolio diversification at peak valuations

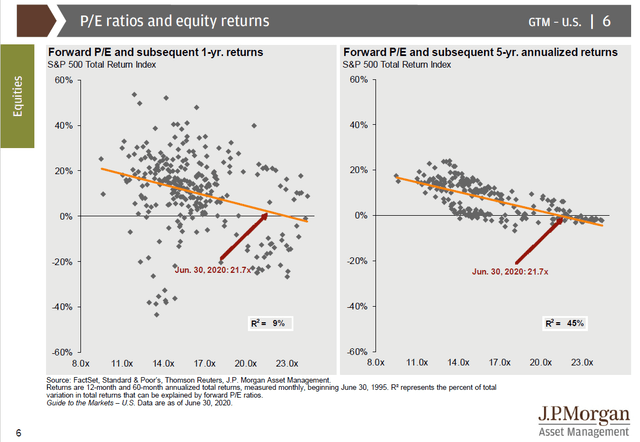

You have probably heard about it a thousand times already: The S&P 500 P/E Ratio is reaching historical high levels, being at 23.2x currently. But you probably haven’t seen the following charts yet: JPmorgan’s research has proven that such high valuations since 1995 always went along with negative returns over the following five years. The R² of 45% indicates that 45% of the five-year S&P 500 price variations are explained by the P/E Ratio, which (statistically speaking) is very high.

As the probability of negative long-term stock returns rises, it’s getting increasingly interesting to diversify your portfolio to different asset classes that don’t correlate with the stock market, so called “safe havens.” Bitcoin can be very helpful in that regard.

The correlation can be found by calculating the beta of an asset compared to the S&P 500. For stocks, the beta generally hovers around 1, which indicates that a stock will go down by 1% if the S&P 500 goes down by 1%. The higher this beta, the more risk you take as the losses will be steeper when the S&P 500 goes down.

I found that over the past four years, the one-year beta of Bitcoin was very low at 0.22. This indicates that including Bitcoin in your portfolio decreases your portfolio risks during a long-term market downturn. Bitcoin is probable to generate positive returns while the market goes down. There were some concerns during the March crash as BTC dipped together with the market, but during this unprecedented crisis everything was correlated, even gold went down significantly. Many see this occurrence as a one-time event.

In fact, Bitcoin can be compared to gold (GLD) as ultimate safe haven. Gold had a beta of -0.12 during this time frame.

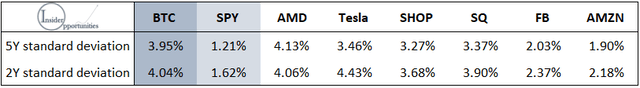

(Source: Insider Opportunities research)

The biggest difference with gold is its higher volatility, which makes many investors prefer gold above Bitcoin. However, it’s important to put this in perspective.

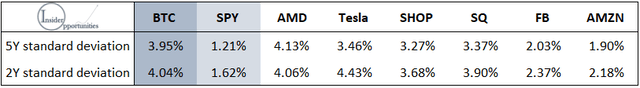

I found that the daily standard deviation of BTC (4.04%) is indeed more than double the standard deviation than the S&P 500 and double that of popular tech stocks like Facebook (FB) and Amazon (AMZN). However, it’s comparable to some of the in-favor tech stocks like AMD, Tesla, Shopify and Square (SQ). If an investor is fine with the risks regarding volatile individual stocks, he/she should not be afraid of Bitcoin’s fluctuations either. Moreover, I expect Bitcoin’s volatility to decrease over time as Bitcoin being a speculative hype looks to be over with lower media coverage and lower intra-day fluctuations.

In short, the S&P 500 is highly probable to generate negative returns from now of on. Astonishingly, including Bitcoin might reduce the risks of your portfolio going forward. Volatility should not be a boundary either, being a lot lower than some believe.

2. Bitcoin hedges against further USD devaluation

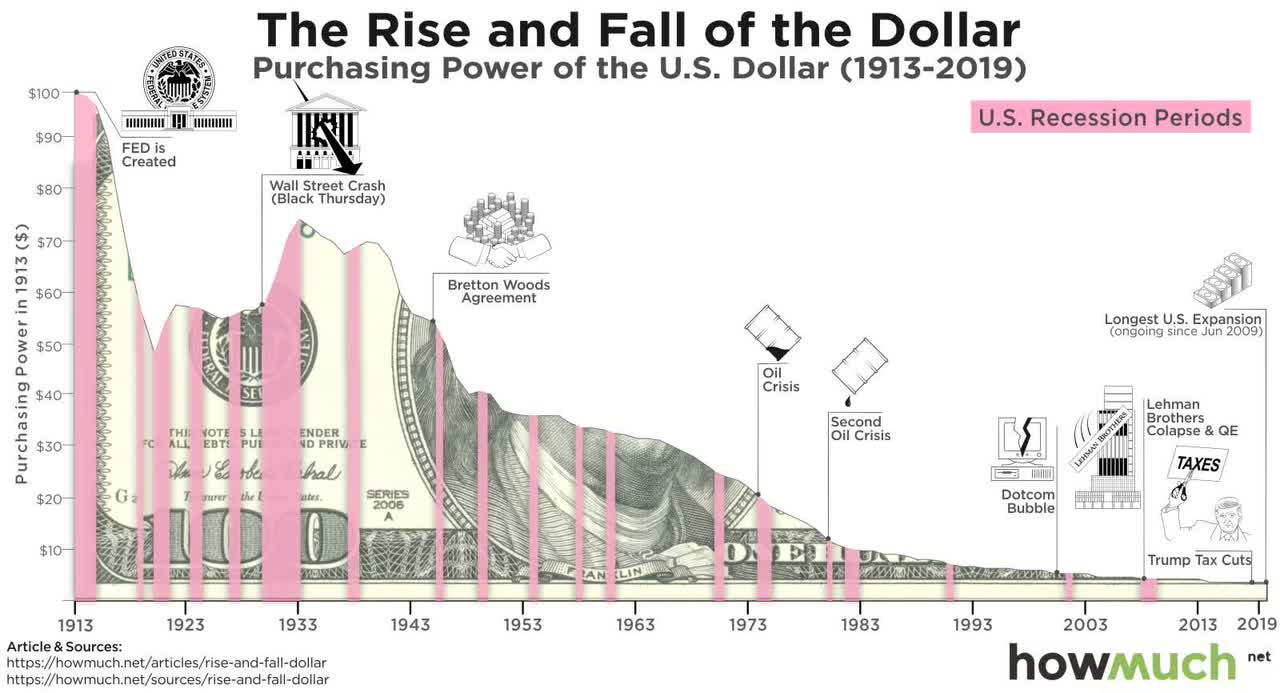

The problem with the dollar is its long-term devaluation. As a consequence of monetary expansion, money which is held in USD decreases in value. In fact, $100 in 1913 is only worth $3.19 today. It’s simple: The value of an asset decreases if its supply increases. The recent monetary expansion of the Fed (~$3.1 trillion USD) will keep destroying the value of US dollars.

(Source: howmuch.net)

On the contrary, Bitcoin has a fixed supply. In fact, it’s the only asset in existence with a guaranteed fixed supply (gold and silver are not, they can be found on our and other planets within our universe).

For each block mined by the miners, a reward will be given in the form of newly-released Bitcoins and spread amongst them based on their computational share in that newly-mined block. The reward of each newly mined block slowly decreases over time. This means that over time the Bitcoin inflation decreases steadily and continuously until the maximum supply of 21 million Bitcoins is reached, which is comparable to the inverse of our conventional Fiat currencies that generally inflate at higher rates over time.

On top of that, every four years, a major event takes place where the total reward per block is suddenly halved: Bitcoin Halving. This literally decreases the inflation rate by half at one given moment. By the time that 21 million Bitcoins have been issued to the miners (which is expected around the year 2140), no block rewards will be released in the form of Bitcoins anymore. Generally, it’s assumed that by that day, the amount of transactions would have been increased enough to give the incentive to miners to keep up the mining in return for the fees that are paid on those transactions.

(Source: bitcoinblockhalf.com)

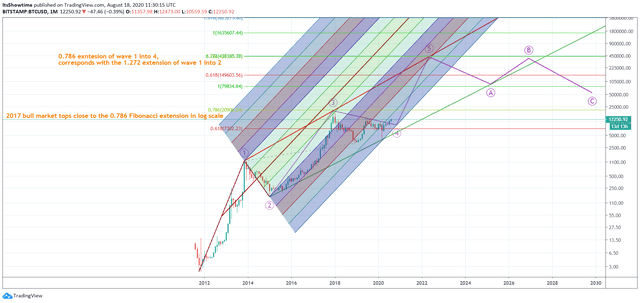

3. Bitcoin just started a new long-term rally

The third reason why Bitcoin could be interesting right now is that it looks to be starting a new long-term rally right now.

Bitcoin Halving has always been the start of a new Bitcoin bull market. As mentioned before, this is caused by the fact that the Halving leads to lower Bitcoin supply, which drives up the price of the asset (supply/demand dynamics). History doesn’t always repeat itself, but I believe that this might happen again.

The third Halving just happened on May 11, 2020. The two prior Halvings lead to a rise of Bitcoin by 12824% and 3103%, respectively, in a two-year time period. I believe that similar growth might be ahead this time as well, also stimulated by the Fed stimuli and stock market uncertainties.

(Source: Insider Opportunities research, with Tradingview)

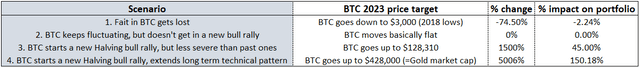

My first scenario includes a similar trajectory as in the past where Halving is followed by a bull rally, but less severe than the prior one. For example, Bitcoin might increase by 1500% over the coming (2) years, which could lead to a price target of $128,310.

A second scenario is a long-term technical one, where the prior two tops get extended. This would give us a top around $428,000 (or a gain of ~5006%).

These, of course, are ridiculously high levels. What’s the possibility that history will keep repeating itself? It’s important to take into account that Bitcoin’s market cap currently stands “only” $217.5 bln, which is approximately 50x lower than the $9 trillion in Gold market cap. As some other Bitcoin experts like Pomp and Bobby Lee stated, it’s not unimaginable that Bitcoin would be valued as much as gold over the coming decade (as in the last scenario) given its elevated supply, superior storability (online), value for other things like payments. And the new rally to these highs might just have started.

How Bitcoin should be included in one’s portfolio

For above-mentioned reasons, I believe Bitcoin might improve your portfolio’s risk/return in the longer term.

Together with high-quality value stocks (discussed here), Bitcoin recently was underappreciated by the market. I believe that including both assets right now might generate strong longer term returns.

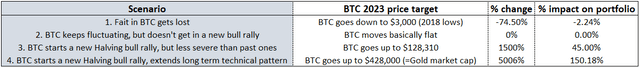

However, it’s important to keep in mind the risks of Bitcoin when including it in your portfolio. Its value is based on demand/supply dynamics rather than underlying fundamentals (similar to gold). I believe it should only be included as long-term hedge against weak stock returns and USD devaluation, for a small part of your portfolio. Initiating a big position would not qualify as risk-mitigating anymore. I would recommend taking a position of ~3% of your portfolio in BTC for the longer term. I believe there might be four scenario’s with this strategy:

Conclusion

Initiating a position in Bitcoin currently is a very attractive opportunity given the high stock valuations, central bank stimuli and recent Halving event. Bitcoin might, in contrast to the popular believe, decrease your portfolio risks if you initiate a small position for the long term. If history repeats itself, Bitcoin might 50x over the coming decade, which would give it a similar value to gold. It’s a “safe haven” asset for investors who are skeptical about the current state of the stock market.

Become a member for FREE now by clicking HERE to receive our current high-conviction picks and get to know the outperforming strategy!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BTC-USD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.